Early last month, a few of Florida Agency Network's executive team checked out this year's National Settlement Services Summit (NS3) in Detroit, MI.

NS3 is one of the title and settlement industry's largest conference. Bringing the industry together to celebrate innovation, recognize accomplishments, and discuss the future of the industry.

Here are a few pictures from the conference.

To see all the photos, click here.

Here's a little disclaimer Aaron M. Davis, CEO of Florida Agency Network, likes to give when speaking on title insurance in Florida.

"Florida, where a judgment can attach to a piece of property simply by filing a document with the clerk, and the name doesn’t even have to be spelled correctly.

Florida, where the county may or may not have to actually FILE an enforcement action on a property for it to attach, as long as they were thinking about doing it at some time.

Florida, where an unlicensed contractor can pull a permit on a house to put on a new roof, not close a permit, and 10 years later you have to hire a licensed contractor to go back, fix the prior’s work, and close the permit.

Florida, were the seller picks the title agent or attorney, and pays for title insurance, but only depending on the county you are in. Or, even depending on what PART of a county you're in."

Across the country, there are 37 states where the buyer picks/pays for title and 12 states where it’s customary for the seller to do so.

Where the Buyer picks in:

Then, seller picks in the majority of the other areas...

HUH???

Title scholars, settlement experts, underwriting counsel, and others who still say things like “HUD statements, policies in triplicate, dot matrix printers, and white out," have contemplated WHY this occurs in Florida.

Title scholars, settlement experts, underwriting counsel, and others who still say things like “HUD statements, policies in triplicate, dot matrix printers, and white out," have contemplated WHY this occurs in Florida.

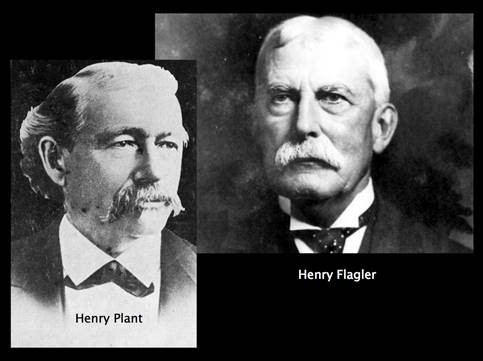

Well, Aaron has figured it out! We can blame two men named Henry. (Of course, it's a man's fault.)

These two gentlemen were railroad tycoons who ventured deep into Florida. The areas they ended up in became tourist destinations, with great beaches, water access, and lots of construction opportunities. Plant’s rail line landed in Sarasota, and Flagler’s line had a few stop down the East coast of Florida, landing in Palm Beach and Miami.

These two gentlemen were railroad tycoons who ventured deep into Florida. The areas they ended up in became tourist destinations, with great beaches, water access, and lots of construction opportunities. Plant’s rail line landed in Sarasota, and Flagler’s line had a few stop down the East coast of Florida, landing in Palm Beach and Miami.

With all those tourists and construction came the attorneys who handled those transactions, several of who previously resided in New York. And in New York, you guessed it - it’s customary for the buyer to pick and pay for title.

As for coastal areas, well, those buyers are typically wealthy, so we guess they just get stuck with the bill.

In case you’ve been living under a rock somewhere, in a cave, underneath the ocean, or Mars, there has been this hysteria around Cryptocurrency. Cryptocurrency comes in several forms, or several coins, we should say, the most popular being Bitcoin. Several others dominating the landscape include Ethereum, Litecoin, Ripple, and approximately 1,600 others at the time of writing this post.

In case you’ve been living under a rock somewhere, in a cave, underneath the ocean, or Mars, there has been this hysteria around Cryptocurrency. Cryptocurrency comes in several forms, or several coins, we should say, the most popular being Bitcoin. Several others dominating the landscape include Ethereum, Litecoin, Ripple, and approximately 1,600 others at the time of writing this post.

The history of Bitcoin is an intriguing story itself, created by Satoshi Nakamoto in 2008 and released weeks following the global market crash leading to the Great Recession. Perhaps more interesting is that Satoshi Nakamoto is still unknown to this day. He wrote the first white paper on Bitcoin, and created the Blockchain database on which Bitcoin resides. However, no one really knows who this person is. Although mysterious and interesting enough, this doesn’t pertain for our purposes here. What DOES pertain is the technology behind Bitcoin, which is the blockchain.

Blockchain is being built up to be the next version of the internet; Immutable ledger system, unhackable, transparent, and definitely disruptive. However, in a good way. There are several industries that will no doubt be affected by blockchain once it gains acceptance and popularity. You can google hundreds if not thousands of companies who already work on adding blockchain to their existing technology and infrastructure. For example, IBM, Chase, Walmart, FedEx, British Airways are just a few. The brilliance of blockchain is its open ledger format. Once a transaction, whether financial or informational, is executed, the nodes on the network all confirm the data and update the ledger, which allows the latest “block” on the “chain” to be added and confirmed.

Industries in third-party payment processing (banks, money transfer companies, credit card companies, payment processors, payroll companies) will all be affected. Medical Industry with the significant amount data and payments will be affected. Even Crowdfunding platforms and gambling sites will be impacted.

But perhaps none more than Real Estate, title insurance, closing and settlement service providers. As blockchain is adopted into these industries, and paper records and PDFs are replaced by blockchain, we can soon envision a day where “click button, buy house” becomes more of a reality.

One company who is certainly progressive in its technology and use of Blockchain is Propy. Propy is a global real estate marketplace with a decentralized title registry. Propy aims to solve the problems facing international real estate transactions by creating a novel, unified property store and asset transfer platform for the global real estate industry. It allows buyers, sellers, brokers, and escrow/title agents/notaries to come together through the utilization of a suite of smart contracts on blockchain to facilitate transactions.

Propy completed the first Blockchain transaction late last year in the Ukraine. Then, in March 2018, they completed the first US transaction in Vermont.

The key to making these transactions happen is to first understand the technology, and second, understand how the flow of currency, whether US Dollars (also known as fiat, or paper money, in the crypto world) or cryptocurrency, work in these transactions. Currently, title agencies and law firms in the US are bound by several laws, regulations and underwriting restrictions which only allow them to accept “good funds” as payment. Right now, good funds are defined as cashier's check or wire transfers cleared via the Federal Reserve banking platform. One reason for this is for tax reporting purposes. Other reasons are for Anti-Money Laundering (AML) and Know Your Customer (KYC) requirements.

There are several companies now working on the exchange integration to convert fiat currency to cryptocurrency, which then would allow for the acceptance of cryptocurrency for closing.

There have been a number of reported transactions who have in fact utilized cryptocurrency to buy a home. However, what likely occurred is the crypto was sold via an exchange, transferred to a traditional banking platform in order to wire US dollars to a title company or law firm's escrow account. One of the issues still unresolved is the 1099 form and taxation of capital gains related to cryptocurrency. The IRS is quickly adapting to the virtual currency world as seen here.

Although there is still much ground to cover, it is truly exciting to see the technological advancements taking place in the real estate and settlement arena.

Recently, we made an announcement about partnering with Cottrell Title & Escrow. This news is starting to trickle out to the masses, and we're excited about it! Our official announcement was featured in a recent The Title Report.

We are thrilled to see others taking interest in what we feel is a great move for the State of Florida.

To read the official announcement, click HERE.

We seem to have an influx of people moving into the state of Florida. The latest census shows upwards of 900 people a day move to Florida. A lot of that has to do with our sunshine, our tax structure (no state income taxes), and our booming economy!

We seem to have an influx of people moving into the state of Florida. The latest census shows upwards of 900 people a day move to Florida. A lot of that has to do with our sunshine, our tax structure (no state income taxes), and our booming economy!

In several areas of the state, there are housing shortages, and with shortages comes opportunity, job growth, construction, a lot of real estate transactions, and more opportunities for a career in the title insurance arena. Think about it. Every piece of land sold needs a title company. Every mortgage given requires title insurance. Every new condo built, apartment complex constructed, or orange grove converted into a subdivision, a title insurance company is often times at the heart of the process.

We've put together this TOP 10 reasons why it’s worth moving to the Tampa Bay Area and starting your career with the FLORIDA AGENCY NETWORK:

1. Beaches

Lots of beaches. You know what a day at the beach has in common with a snowstorm in Minnesota? ABSOLUTELY NOTHING .

2. The Tampa Bay Lightning

Yes, we have hockey in Florida. Perhaps you’ve heard about this guy Jeff Vinik? He owns the Lightning, and has pledged nearly $3 Billion dollars in infrastructure, improvements, new development, and more into Downtown Tampa and Channelside areas.

3. Did you hear Mosaic is moving its headquarters here?

Mosaic, a Fortune 500 company is moving its headquarters from Minnesota (sorry guys) to Tampa Bay. All those execs need housing and title work. Just sayin’.

4. Florida Winters

Also known as “Those 2 days in January the temperature gets into the 50’s.” Brrrr….bundle up!

5. Cryptocurrency and Blockchain

Currently, we are involved in numerous conversations nationwide on providing solutions in this space. And yes, we can transact on a home using Bitcoin.

6. Technology

We consider ourselves to be an IT/Software/Technology company cleverly disguised as one of Florida’s Largest Title agencies. Google FLORIDA AGENCY NETWORK to see our numerous releases and media coverage, like this one or this one.

7. Disney World

Need I say more? Seriously, anywhere in the state is a only few hours from The Happiest Place on Earth. Orlando offers so much to do you’ll never get enough. More parks, more rides, more attractions, and more FOOD!

8. Ybor City

This area is a MUST SEE! Loaded with food, history, culture, cigars, and possibly, the TAMPA BAY RAYS! Ybor offers a little something for everyone.

9. Bern's Steakhouse

A signature staple in the Tampa Bay area, Bern's Steakhouse has been rated the #1 steakhouse in Florida. Take a step back in time with it's amazing atmosphere and private dessert room. Bern's has the largest private wine collection in the world with over 600,000 bottles.

10. The FLORIDA AGENCY NETWORK

Our organization is an awesome place to work and call home! We have some of the absolute best people in the business here. Large company perks with small company culture. We are statewide, have some amazing systems and solutions, phenomenal leadership of people who truly care about you and our clients.

So if you are looking to be a title closer in Gainesville, a title processor in Naples, a licensed title agent in Destin, or an IT professional or programmer in Tampa, the Florida Agency Network may have the position for you.

Thanks to our growth, we are always looking for experienced closing agents, processors, and title curative positions. However, we also look for examiners, lien search processors, accounting personnel, and several other career paths not often found in a traditional title agency or law firm.

So….ready to move?

Click HERE for more information on the positions we have available, or send your resume to careers@FLagency.net.

As with most things in life, everything starts with a vision.

“In the world of real estate settlement services, it’s a vision to buy, refinance, and sell a house on a tablet device. No pens. No paper. No rubber-stamped notary seal. No 100’s of pieces of paper to be purchased, printed, signed, shipped and scanned. Oh, and shredded, who can forget shredding? Don’t get me started,” says Aaron M. Davis, CEO of Florida Agency Network (FAN).

For the world of real estate closings, the vision has been for years to transform an industry’s archaic processes through innovation and new technology. Aaron has made FAN’s purpose to innovate and blaze the path for homeownership to become more seamless, paperless, and less cumbersome for the consumer. His passion for revolutionizing the title insurance industry started decades ago, sitting in his mother’s title agency in Plant City, Florida.

“I remember the days of hand balancing HUD statements. Policies in triplicate form. Our first fax machine, our first desktop computers, Novell servers, dial-up modems, and paper. Lots and lots of paper. 200 pieces of paper per file, 30 files per storage box, and lugging boxes of files in and out of storage.”

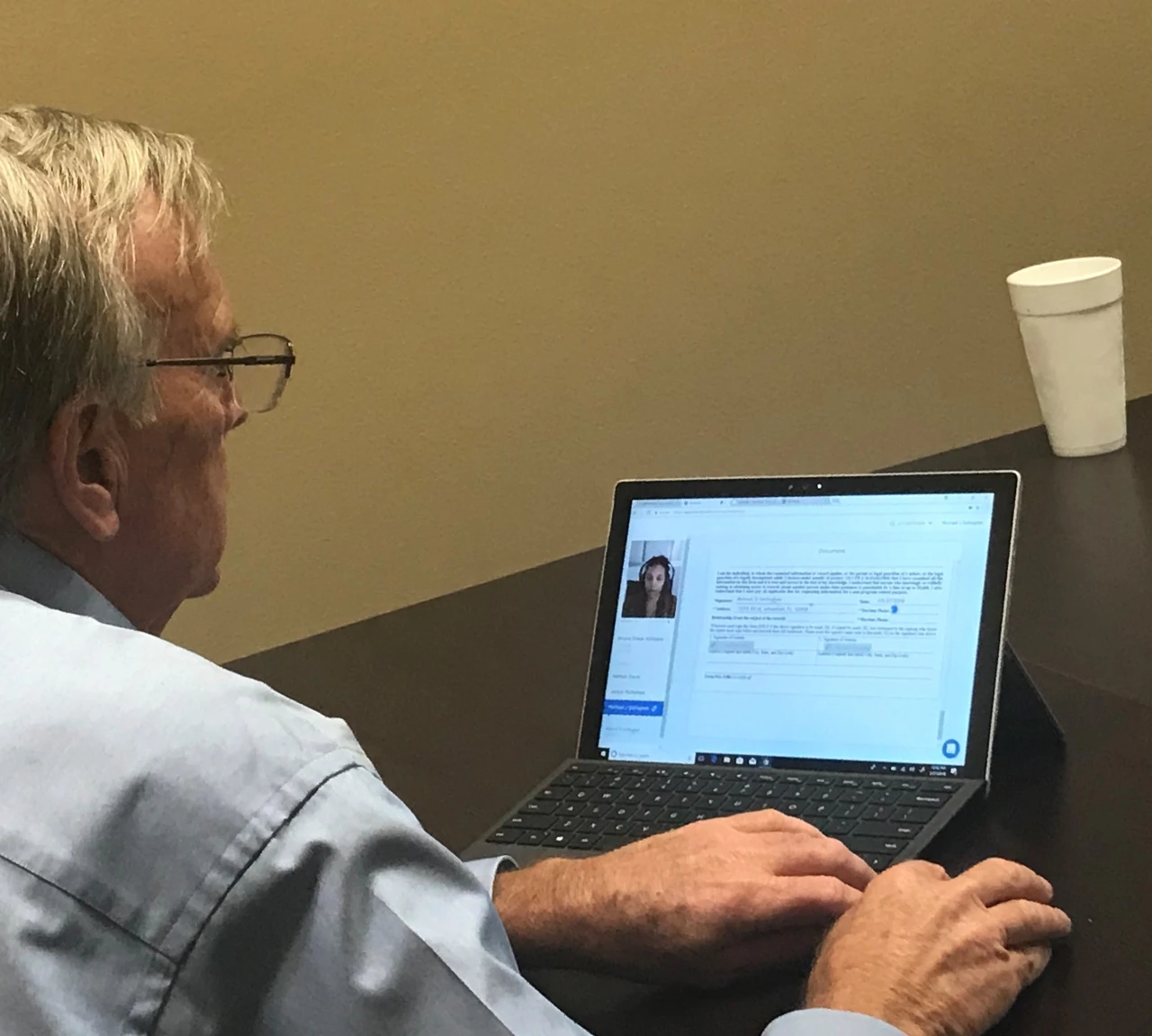

Settlement has come light years from those days, however one piece has been missing. Remote Online Notarization, or RON for short. The ability to interface remotely via safe, online portal, digitally signing documents, and affixation of the electronic notary seal, all on a tablet device.

Pat Kinsel started Notarize because he had one too many bad notary experiences. In his case, the last straw was a notary agent who forgot to sign his document just before he went on vacation. He didn’t learn of the error until he was gone. Pat knew “there has to be a better way!”

Developing that better way required a sharp focus on innovating both in the areas of technology and public policy. In researching the process, Pat discovered the Commonwealth of Virginia had passed a law in 2011 to become the first state to allow remote electronic notarization, and all 50 states must recognize Virginia’s ability to transact business in this new way. Building upon these policies, and with cooperation from the Commonwealth of Virginia, Pat and his team have spent the past years developing an amazing product to fundamentally transform the notary process for consumers, businesses, and agents. Technology and policy have converged, and Notarize is bringing notary into the 21st Century.

When Aaron met the team at Notarize in mid-2017 and demoed their product, he knew he had just witnessed the missing piece to the puzzle, and the future of real estate settlement: Paperless, convenient, efficient, and best of all, secure.

Fast forward to today, thanks to a partnership and friendship with Pat Kinsel and Adam Pase of Notarize, FAN could collaborate with a company whose vision and innovative pursuit in the online closing space is revolutionizing the real estate closing process. One final element in the equation came down to the backing from Westcor Land Title Insurance. With Westcor’s support and Notarize’s technology, FAN conducted its first fully-digital, 100% paperless, remote online notarization closing in March 2018.

The vision didn’t stop there. “After completing our first fully-digital purchase transaction using an online notary earlier, we knew the next step would be utilizing the technology for a refinance transaction,” said Aaron.

Hillsborough Title, a proud member of Florida Agency Network, suggested to one of its borrowers, Mr. Gallagher, to close his refinance transaction digitally. During the closing, Mr. Gallagher exclaimed that his digital experience was “very efficient” and “superb.” That was the goal; It’s about providing convenience and ease of use to consumers. “Our borrower was thrilled at the efficiency throughout the entire process. This transaction was a keybreakthrough in providing our clients the option of a fully digital remote closing at the time and location of their choosing,” said Aaron.

As the Chief Operating Officer of Florida Agency Network, Mike LaRosa said, “We were fortunate to have all of the necessary parties willing and able to take this historic step for the Florida title insurance industry. The Notarize platform made the idea of a RON closing experience a legitimate possibility, and the forward thinking of Westcor made it a reality. Finally, combining the right real estate, lending, and title partners allowed for a cooperative experience for Mr. Gallagher, our mutual end-consumer. We were obviously thrilled to be a part of history, and also to be able to offer Mr. Gallagher, and our future clients, this unique experience.”

Everyone working on the transaction couldn’t help but celebrate how convenient it was to close, and how they had just witnessed the future of settlement. Jackie McNamee, the closing agent for Hillsborough Title said, “I am so excited and proud to have been a part of this first fully-digital loan closing experience.” While Nate Davis, Owner of Florida Mortgage Firm said, “The days of long drives to title offices, scheduling time off work for the sole purpose of signing docs, and overseas clients searching for U.S. notaries will soon be a distant memory with this platform.”

There will always be a time and place for physical closings, the coming together of buyers, sellers, real estate agents, and lenders to meet and sign at closing. This gives a great alternative should a party not physically be able to attend.

But won’t it be great to do it all digitally. All on a tablet.

Naples, Fla. – May 9, 2018 – Florida Agency Network (FAN) is joining forces with Cottrell Title & Escrow located in Naples, Florida. This partnership amongst independently-owned title insurance agencies aims at expanding the organization’s footprint into certain key Florida markets.

“We're excited about bringing Cottrell Title & Escrow into the FAN family. We appreciate the way their organization does business, and feel Cottrell will make an excellent addition to our team,” says Aaron M. Davis, CEO of the Florida Agency Network. “Both of our companies share the same vision and commitment to industry compliance standards. Combining our energies and expertise to serve a broader range of customers will help deliver more efficient solutions across the state.”

“After having in-depth conversations with FAN Management about where the title industry is headed over the next 3-5 years, it was evident that both of our companies have similar goals and missions to provide the best closing experience for our clients,” stated Justin Cottrell, Esq. Founding Partner of Cottrell Law Group.

Cottrell Title & Escrow will use multiple back-office solutions provided by Florida Agency Network (FAN), with the goal of centralizing non-core title services and allowing for a sharper focus on servicing their clients and maintaining industry-leading security and protection of NPPI via added compliance controls. This relationship marks the second independently owned and operated partnership of its type for FAN, the first being SETCO Services in North Florida’s panhandle region. Both strategic partnerships provide valuable services to the partner entities, while providing FAN with additional geographic coverage throughout key Florida markets.

“Even more rare, and ultimately what attracted us to this opportunity, is that both brands have proven the ability to execute their ideas and innovations at a high strategic level. We are grateful to be able to put our resources together through the Florida Agency Network affiliation and continue to raise the bar and provide enhanced peace of mind for our clients and industry partners.” Stated James P. Schlimmer, Managing Partner of Cottrell Title & Escrow

About Cottrell Title & Escrow

Cottrell Title & Escrow is a settlement service provider located in Naples, Florida. Cottrell Title & Escrow’s mission and primary goal is to save real estate agents, brokers, lenders, and their clients time and provide enhanced peace of mind during the closing experience.

We had the honor of attending this year's Alliant National Agent Summit in Clearwater, FL. It was wonderful meeting all the agents attending and to see our partners killing it as sponsors!

Tampa, Fla. – April 3, 2018 – Florida Agency Network announced the completion of its first 100 percent paperless, fully-digital real estate refinance transaction with United Wholesale Mortgage and Florida Mortgage Firm. The closing was completed at the office of Florida Mortgage Firm. All closing documents were executed electronically, and the Electronic Notarization of mortgage and affidavits was performed by Notarize via an online interface.

“After completing our first fully-digital purchase transaction using an online notary earlier this month, we knew the next step would be utilizing the technology for a refinance transaction,” said Aaron M. Davis, CEO of Florida Agency Network. “Our borrower was thrilled at the efficiency throughout the entire process. This transaction was a key breakthrough in providing our clients the option of a fully digital remote closing at the time and location of their choosing.”

Hillsborough Title completed the transaction utilizing remote online notarization via Notarize, the first notary public platform allowing any person or business to get their documents legally notarized online, and Westcor Land Title Insurance Company, who underwrote and issued the title insurance policy.

“It is exciting to be a pioneer in the Florida market with the e-close experience. The days of long drives to title offices, scheduling time off work for the sole purpose of signing docs, and overseas clients searching for U.S. notaries will soon be a distant memory with this platform. Physical closing attendance will always be an option for consumers, but this added convenience will be a solution to a multitude of scenarios that will benefit our customers,” said Nate Davis, Owner of Florida Mortgage Firm.

Please fill out form below