Co-opetition might just be one of the most important concepts of this millennium, although many will argue it’s all about artificial intelligence.

Co-opetition might just be one of the most important concepts of this millennium, although many will argue it’s all about artificial intelligence.

But setting the potential and unknowns of AI aside for a moment, let's explore the idea of growing your business through a series of partnerships that expand your reach and vastly improve your ability to serve your customers.

According to Investopedia, the idea of co-opetition originated in game theory, where competitors seek to create strategies with competitors to improve their chances.

Investopedia explains the approach in business as such: “The model is initially drafted using a diamond shape, with customers, suppliers, competitors, and complementors in each corner. The aim of coopetition, and the model itself, is to move the market from a zero-sum game, where a single winner takes all, to an environment in which the end result benefits the whole and makes everyone more profitable.”

In the real estate industry, where so many partners are dependent on each other for a host of services, the title insurance industry – more than most – seems perfectly positioned to exploit the growth of technology and AI by crafting well-thought-out relationships with competitors through coopetition.

There are many benefits to be gleaned in a co-opetition arrangement, but let’s consider some key advantages in the title insurance industry, including shared resources, competitor alliances, and complementary skills and knowledge.

Shared resources

Sharing resources can be a natural and easily achievable cost-cutting venture between competitors in the title industry. One simple example is sharing closing room space. If each competitor operates five closing rooms across their market area, they can easily double their access to a wider range of communities by partnering with a competitor who also operates five closing rooms. Marketing and advertising resources can also be shared if the two competitors offer diverse services where the two are not going directly head-to-head in the marketplace.

Competitors can form alliances that help them gain a competitive edge against larger players in the market or allow them to share resources. Florida Agency Network (FAN) is a conglomerate of independent title agencies that share back-office services, pooled resources, access to technology, and the ability to offer their clients greater geographic coverage throughout Florida.

Partnering with agencies that offer a particular skill set is a natural fit for the title insurance industry. For instance, an agency focusing on residential services can partner with another focusing on commercial transactions or apartment or condo developments to strengthen its brand in the marketplace.

Not to be too pie-in-the-sky, there are potential drawbacks to partnering, including conflicts when setting strategies or between each partner's mission or value system. There is also the potential for sharing too much information with a competitor that poses a risk for the future, for instance, access to customer information or trade secrets that may be exploited by your competitor in the future.

Because of the risks, partnering with competitors requires serious due diligence, thoughtful planning, and a commitment to navigating the challenges. But the benefits can be huge.

Stay tuned for part 2 on partnering with competitors, where we examine various models and options for creating a variety of strong partnerships in the title insurance industry.

As you begin crafting your coopetition plan, we can provide enhanced tools and resources to you and your chosen partners to help you meet your shared aspirations. Contact us today to learn how we can help you optimize your agency with back-office support, improved technology and sophisticated transaction solutions.

Achieving sustained growth in the real estate industry is no small feat. It requires adaptability, foresight and a willingness to leverage available tools and resources. Whether you're a seasoned professional or just starting, these six strategies can help you thrive in an ever-evolving market.

Achieving sustained growth in the real estate industry is no small feat. It requires adaptability, foresight and a willingness to leverage available tools and resources. Whether you're a seasoned professional or just starting, these six strategies can help you thrive in an ever-evolving market.

Technology has revolutionized the real estate industry. Adopting tech-driven tools can improve efficiency, expand your reach and provide exceptional client experiences.

The real estate industry constantly evolves, with new regulations, market dynamics and client expectations. Staying informed and proactive is critical for sustained growth.

A strong network is the backbone of a successful real estate career. The relationships you build today can lead to referrals, collaborations, and valuable opportunities later.

Great client relationships are at the core of any growing real estate business. Creating memorable client experiences can lead to lasting loyalty and referrals that are the foundation for long-term success.

Diversification allows you to appeal to a wider audience and capture new revenue streams. Offering a variety of services can also provide stability by balancing market fluctuations.

Knowledge is power, especially when staying ahead in the real estate business. Being proactive rather than reactive to market shifts can set you apart.

Sustained growth in real estate isn’t about following a one-size-fits-all formula—it’s about evolving with the industry, maximizing opportunities and maintaining strong relationships. Adopting advanced technologies, prioritizing education, expanding your network and offering diverse services can position you for long-term success.

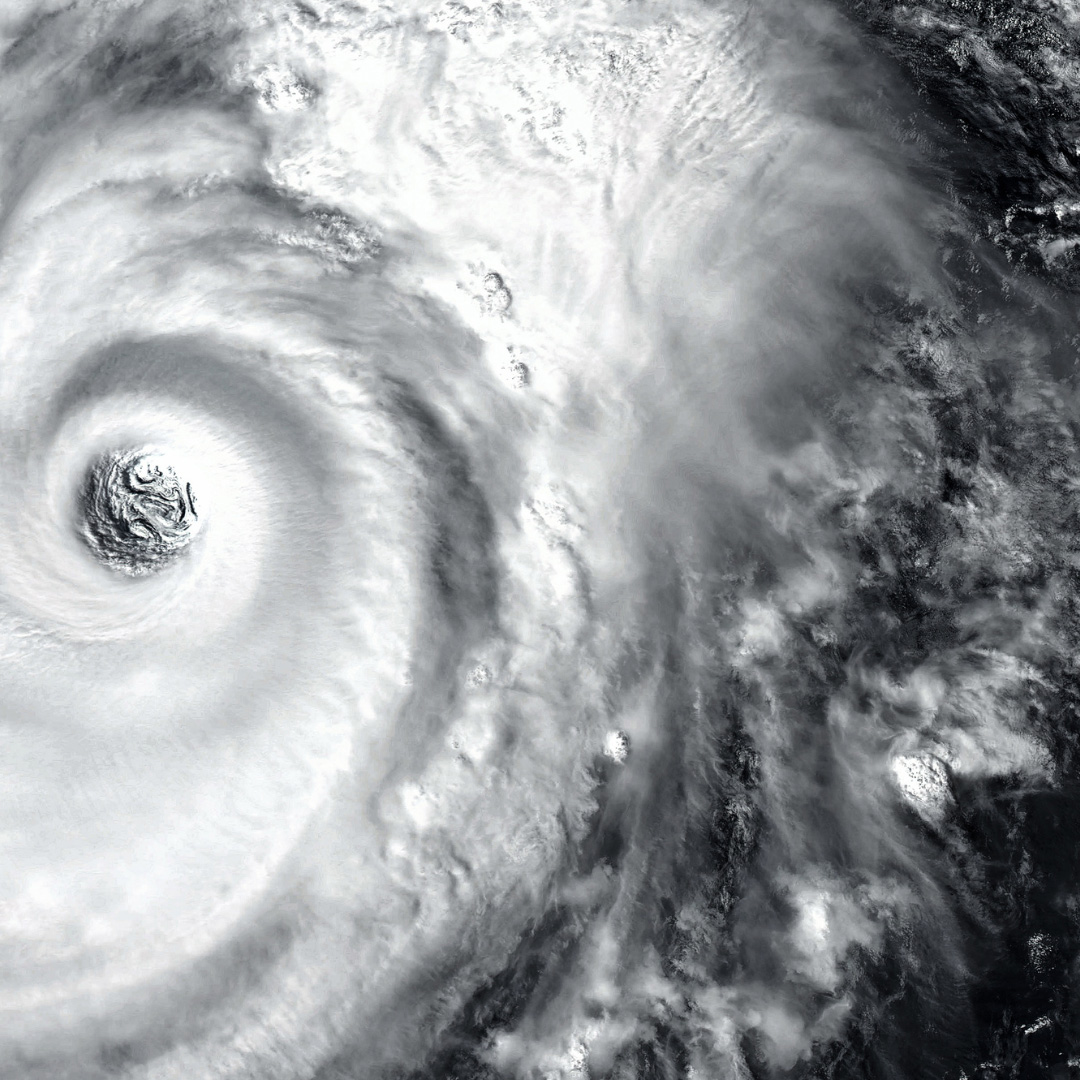

Hurricanes can leave behind a path of devastation, not just in physical damage but also in emotional and financial stress for homeowners. Florida knows this reality all too well. Hurricane Milton alone caused over $3.3 billion in losses from 309,000 claims, while Hurricane Helene resulted in $2 billion in losses from 135,000 claims. Despite these staggering numbers, hope is not out of reach. Various recovery programs continue to assist Floridians on their path to rebuilding and resilience. Here’s a closer look at available relief options and how they can help.

Hurricanes can leave behind a path of devastation, not just in physical damage but also in emotional and financial stress for homeowners. Florida knows this reality all too well. Hurricane Milton alone caused over $3.3 billion in losses from 309,000 claims, while Hurricane Helene resulted in $2 billion in losses from 135,000 claims. Despite these staggering numbers, hope is not out of reach. Various recovery programs continue to assist Floridians on their path to rebuilding and resilience. Here’s a closer look at available relief options and how they can help.

The My Safe Florida Home program is a game changer for homeowners looking to bolster their property against future storms. Eligible homeowners can take advantage of free wind mitigation inspections, which identify improvements that can strengthen the home's structure and potentially lower insurance premiums.

For those ready to make suggested upgrades, the program offers matching grants of up to $10,000 for hurricane mitigation projects. Here’s how it works: Florida matches $2 for every $1 a homeowner spends, turning a $5,000 commitment into an impressive $15,000 project budget. Even better is the expanded support for lower-income households—grants have increased from $5,000 to $10,000, allowing more families to participate. Funds are reimbursed directly to homeowners once the work is complete, making this program accessible and straightforward for those who qualify.

Devastation from Hurricane Ian took a toll on thousands of vulnerable Florida residents, making the Rebuild Florida Hurricane Ian Housing Repair and Replacement Program a lifeline. This initiative provides financial assistance for repairing, replacing, or fully reconstructing damaged homes, including mobile homes.

Whether a house requires a few critical repairs or a complete rebuild, this program ensures homeowners can restore their properties to safe, habitable conditions. By targeting vulnerable populations, Florida ensures that hard-hit families have the resources to regain stability.

The Federal Emergency Management Agency (FEMA) is a vital resource for hurricane relief, offering over $1 billion in federal aid to Florida homeowners and renters affected by Hurricanes Milton, Helene, and Debby. FEMA support spans a wide range of needs, including:

Grants for temporary housing: Ensuring displaced residents have a safe place to stay.

Home repairs: Providing financial aid to fix hurricane-damaged homes.

Other disaster-related expenses: Covering uninsured or underinsured costs related to essential

needs.

Applying is easy. Affected individuals can register online at DisasterAssistance.gov, use the FEMA App, or call the hotline. FEMA’s commitment to helping homeowners rebuild stronger communities is invaluable during crises.

The U.S. Department of Housing and Urban Development (HUD) offers additional support for homeowners facing hardship due to hurricanes. Programs include:

Eligible homeowners are encouraged to contact their mortgage servicers to explore HUD’s resources further. This direct communication ensures families can access help tailored to their unique situations.

Administered by Florida Housing, the SHIP program extends vital disaster relief resources to those in need. It provides funding for:

This program is a critical pillar in Florida’s recovery effort. It ensures that disaster-affected households have the support they need to rebuild and thrive.

Rebuilding after a hurricane is more than just repairing physical damage; it’s about restoring families' sense of normalcy and safety. The programs highlighted above help homeowners get back on their feet and encourage future storm preparedness through improved housing resilience. From financial aid to hands-on repair assistance, these initiatives show that Floridians are not alone in their recovery journeys.

If you’re a Florida homeowner affected by recent hurricanes, take the time to explore these relief programs. They’re designed to ease the financial burden of recovery, offer practical solutions for rebuilding, and set you on the path to future resilience. Whether securing grants for structural improvements, accessing federal disaster aid, or tapping into local housing initiatives, the resources help you every step.

Do you have questions or need guidance? Contact local housing authorities, mortgage servicers or disaster recovery teams for personalized support. Together, we can rebuild stronger and safer homes for all Floridians.

As a sizable percentage of title professionals look forward to retirement in the coming decades, companies are looking to hire and train a younger generation of workers.

As a sizable percentage of title professionals look forward to retirement in the coming decades, companies are looking to hire and train a younger generation of workers.

This may be of critical importance in the coming decade, as the insurance industry overall is experiencing a talent gap that can only be filled through effective strategy on the part of company owners.

Understanding what the younger worker requires in their working environment, and how this might differ from current expectations within your agency, will help you better craft a plan for attracting, hiring, training and nurturing young talent.

Historically, the title insurance industry brought in talent through word of mouth, or more importantly, through family connections, with sons and daughters often following in their parents’ footsteps.

In today’s environment, a title company looking to hire and train new talent must broaden their reach to attract young professionals, which can only be accomplished through modern means, i.e., the internet.

To do that effectively, a company must first develop a strong culture internally, which they must then brand out on the airwaves. To be effective with the younger generations, the agency should focus on their value proposition, including everything they can offer a candidate, such as diversity, technology, upskilling and the potential for a strong career path.

Explaining the title insurance industry to candidates to make it sufficiently attractive can be an uphill battle for an industry that is often hidden from view. Couching the various facets of the industry in more common parlance will overcome initial resistance – i.e., sales, marketing, data processing, etc. will at a minimum get candidates in the door. Then it’s up to the hiring managers to present an enticing picture of the industry as a defined career path as well as selling the candidate on the company’s culture.

Younger employees have been born into the digital age and are used to being in constant learning mode. This is a great advantage to title insurance agencies where there is a lot to learn and ample opportunity for eager workers to contribute across multiple departments.

Title owners know how important it is to have a nimble staff who can easily step into various roles as the business ebbs and flows. This eager, younger generation can be a boon for an agency manager who is eager to keep the work fresh and interesting by offering regular training opportunities as well as hands on experience in various departments.

The younger generation of workers has proven to be highly mobile, compared to the Boomer generation that was more prone to locking into a single career or single company for much of their career.

The best way to keep this generation from straying to greener pastures is to commit to offering a clear path for them to grow within your company and check in to ensure they are happy with the progress they are making. This is not something you can pay lip service to. They will know when they are stalled out and will not hesitate to seek greener pastures.

Florida Agency Network (FAN) is an alliance of title agencies and service providers that share back-office services, pooled resources, access to industry-leading technology, improved efficiencies, and the ability to offer their clients greater geographic coverage throughout Florida. Contact us to learn more about how our strategic alliances can help you expand your business opportunities in the coming year.

The real estate industry, with its dozens of players involved in a single mortgage transaction, is ripe for creating alliances and business ventures that can be a boon for your business.

The real estate industry, with its dozens of players involved in a single mortgage transaction, is ripe for creating alliances and business ventures that can be a boon for your business.

And while real estate is primarily a local business, with the increasing number of homeowners tapping into vacation properties and investors managing rental properties across the country, there are vast opportunities for building joint ventures and strategic alliances that serve customers across state lines.

While both joint ventures and strategic alliances are created by two entities with the goal of collaborating for the purpose of increasing business opportunities, saving money or expanding services, the way in which they are set up is quite different.

Here are some pointers on the differences between these two approaches.

To begin with, a joint venture (JV) or affiliated business arrangement (ABA) is a venture created by two distinct companies and is established by formal agreement as a separate business entity. This means that all of the finances of the new company exist within that new entity and remain separate from the finances of the companies who created the venture.

There are a lot of advantages to a JV, including the fact that it is less expensive to create than a merger or acquisition, for example, and can be time bound, meaning it can be dissolved when its usefulness has ended for the partners.

Usually, a joint venture is formed when two companies having diverse capabilities form a new company to capitalize on the strength of the combined resources or expertise. In the title industry, it is common for JVs to be created with real estate agents, homebuilders and mortgage companies to provide an entity that is uniquely dedicated to the customers who choose to work with the new venture.

Strategic alliances are a much more casual relationship between two companies, where the companies come together to achieve a specific goal without the formality of a legal partnership.

Commonly, the purpose of an alliance is to share resources. For instance, several graphic artists may form an alliance to share office space, equipment and general office support to save money. The alliance may also provide business building opportunities as they share leads or recruit each other to work on larger projects.

In the title industry, an alliance between two title companies – each of which have specific expertise in different areas or who cover different territories – allows the companies to funnel work to each other as needed or share office space in their respective regions for closings.

One of the most powerful ways to leverage strategic alliances in the title insurance industry is when agents set up a relationship with companies in other states who regularly do business in their state. This is most common in states like Florida, which entertains a lot of out-of-state purchasers for retirement homes, vacation homes, and investment properties. Setting up an alliance allows agencies in both states to benefit and provides the out-of-state agent a reliable contact onsite to manage the in-state requirements.

Title agents who are interested in expanding their business in 2025 have a lot of options for strategic growth in the current highly entrepreneurial environment. The sky’s the limit for agency owners with a vision for the future and a predilection for innovation.

Whatever method you choose to grow your agency in the coming years, we can provide enhanced tools and resources to help you meet your goals. Contact us today to learn how we can help you strategically grow your agency as well as optimizing your operation with back-office support, improved technology and sophisticated transaction solutions.

At the end of 2023, the U.S. economy was teetering on a recession. Consequently, this past year presented an uncertain landscape for the real estate markets, with inflation unchecked and mortgage rates in untenable territory.

At the end of 2023, the U.S. economy was teetering on a recession. Consequently, this past year presented an uncertain landscape for the real estate markets, with inflation unchecked and mortgage rates in untenable territory.

While much of the uncertainty diminished throughout 2024, the real estate market did not fare as well as might be hoped, and the industry faces the recurring challenges of low inventory and stubbornly high interest rates heading into the new year.

However, there is light at the end of the tunnel, and there are many economists who are giving us hope for a stronger year ahead.

While you may not be concerned about the world economy as you set out a business plan for your corner of the world for 2025, U.S. real estate is impacted by what happens elsewhere, from supply chains to foreign investors, so it will, in fact, have an impact.

The International Monetary Fund in its recently released global outlook reported that the global battle against inflation has been won and moderate growth is anticipated.

“After peaking at 9.4 percent year-on-year in the third quarter of 2022, we now project headline inflation will fall to 3.5 percent by the end of next year, slightly below the average during the two decades before the pandemic,” IMF noted. “In most countries, inflation is now hovering close to central bank targets, paving the way for monetary easing across major central banks.”

The organization also found the global economy to be “unusually resilient throughout the disinflationary process,” with growth projected to hold steady at 3.2% in the coming year.

The U.S. economy performed much better than expected in 2024, as the country fended off a recession and got inflation under control. David Mericle, chief US economist in Goldman Sachs Research said he believes the country is on course to grow GDP by 2.5% in 2025.

“Consumer spending should remain the core pillar of strong growth, supported both by rising real income driven by a solid labor market and by an extra boost from wealth effects,” Mericle wrote in his November Outlook report. “And business investment should pick back up even as the factory-building boom fades.”

All of this should be good news for real estate, but while the economy is on track, Fannie Mae and Freddie Mac are less optimistic about the real estate market.

Fannie Mae and earlier forecasted an 11% jump in home sales in 2025, but have dialed that back to 4%, due to their belief that mortgage rates will not drop below 6% throughout the year. The GSE is more hopeful about 2026, suggesting a 17% jump in activity as interest rates finally decrease and pent-up demand fires up the market.

Freddie Mac matched Fannie Mae’s more subdued prediction, although it was upbeat about refinance business.

“For 2025, we expect the decline in rates to boost refinance origination volumes,” the company said in its November Economic, Housing and Mortgage Market Outlook. “This, coupled with expected increase in purchase originations due to a modest growth in home sales and home prices, should improve the mortgage market in 2025. We forecast total origination volumes to increase modestly in 2025.”

Freddie Mac highlighted in its report that the housing shortage is weighing on the real estate market, noting that they estimated the housing shortage will stay stubbornly in the 3.7 million range.

Anyone who has been in this business for any length of time knows that the situation could change for a whole host of reasons. The wisdom is to create a business plan for known factors and revisit it throughout the year as the market evolves.

Florida Agency Network (FAN) is a conglomerate of independent title agencies that share back-office services, pooled resources, access to industry-leading technology, improved efficiencies, and the ability to offer their clients greater geographic coverage throughout Florida. Closing Suite leverages those resources to support title agencies achieve strategic growth and more efficient operations, as well as providing strategic consulting services on crucial topics such as growing geographic footprint by building affiliated arrangements and other partnerships. Contact us to learn more about how our strategic alliances can help you expand your business opportunities in the coming year.

There are three key components to successfully navigating an increase in title work, and with recent economic indicators pointing to a more dynamic 2025, it may be the perfect time to take a hard look at your managers, technology and processes to determine if you are prepared to gear up for the New Year.

There are three key components to successfully navigating an increase in title work, and with recent economic indicators pointing to a more dynamic 2025, it may be the perfect time to take a hard look at your managers, technology and processes to determine if you are prepared to gear up for the New Year.

Managing your managers is as important as anything you will ever do in your agency. This means modeling the type of leadership you expect from them as well as providing the education and training they need to get better at what they do.

Sometimes agency owners can be guilty of looking past their managers to the staff who are in the trenches all day churning out the work. You may be great at setting up regular training programs for the general staff, cross-training for greater efficiency, and providing education and mentoring opportunities. But do you do the same for your managers?

While your staff needs to understand the mechanics of the business to do their jobs effectively, your managers need to have effective leadership, organizational and motivational skills to keep the engine running at top speed.

As a company executive, make sure your managers are provided with equivalent opportunities to learn and progress in their leadership roles as your team has at honing their skills at title, escrow, sales or marketing.

This is also the perfect time to check in with your managers to find out what resources they think they are going to need for 2025. Every department is going to be quite different in what they require, so this is by no means a cookie cutter process. For some it will be more manpower, but for others it may be innovative technology or a revamping of processes.

The most effective company executives are often the best listeners, and as you are thinking through your business plan for next year, make sure you gather as much information and perspective from your managers as possible to lay the appropriate groundwork for success.

Technology is a critical factor when contemplating future growth in the title insurance industry. Technology continues to make leaps and bounds in ways that help agency managers cut costs; reduce the length of time it takes to process title, prepare escrow and close a transaction; and improve overall services for your customers.

To prepare for an uptick in business, now is an advantageous time to do a complete audit of your technology platform and determine what improvements and additions can help you effectively streamline your service delivery for faster turn times.

Processes can sometimes break down or grow cumbersome over time as the type of business you are handling changes or new staff or technology are buttoned on to old ways of doing things. Quite frankly, when business is slow, you may not notice the hiccups. But when the wave of title orders starts to rise, it puts pressure on processes that may not be integrated properly due to other changes you have made in the company.

Before the ball drops on Times Square to mark the end of 2024, set aside some time for staff and management to make a thorough review of processes and consider making changes now to reposition your company to manage the type of business that is likely to come your way in 2025.

We can help you optimize your planning for 2025! At Closing Suite and FAN, we can provide access to packaged business capabilities as building blocks to compose unique and differentiating digital initiatives to provide our title agents with agility, innovation and reduced time to market for all their initiatives. Contact us today to learn more!

Please fill out form below