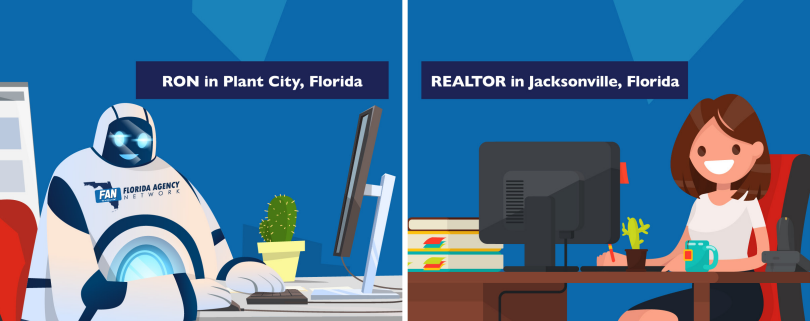

You can be remote from your Client and still be able to attend the closing as the witness!

When the closing is being scheduled for your clients, you have the ability to request that your Closing Team add you as the Witness and provide the video link for the RON eClosing.

Requirements:

(You will then get an email the day of the closing inviting you to join the RON eClosing)

(You can NOT use a phone or tablet)

Be sure to ask your local FAN Title office for more information or visit www.eclosefan.com.

The purchase or sale of a home can be intimidating. As a buyer or seller, we want to make sure fully understand everything happening throughout the closing process.

We can help you get better acquainted with each step of the closing process to help avoid surprises along the way. View our quick breakdown of the steps to close below and let us know if you have any questions:

Once a buyer's offer has been accepted and the sales contract has been fully executed, Real Estate Agent will submit that contract to the title insurance agent.

Once a buyer's contract is submitted, they'll receive information on sending their earnest money deposit to be held in escrow for the closing. We have several options available for the delivery of the EMD. Please note: Buyers and sellers should always call to verify any wire instructions with the title agency and/or closing agent.

During this time, the inspections are being ordered and completed, be sure to stay on top of all deadlines and critical dates per the contract.

The title insurance company will search and examine public records, which include deeds, mortgages, liens, wills, divorce settlements, and more.

After the search is completed, an examination is carried out to determine legal ownership, debts owed, whether there are any liens in place, etc.

Once both of these steps are completed, a title commitment is completed and sent out.

Once the title commitment is issued to all parties, the closing agent will gather critical information needed to prepare closing documents.

During this time, the appraisal and loan approval will also occur.

Once the closing agent has all the necessary information and approvals, the Settlement Statement is prepared. Then, the statement will be sent to the Lender for review and approval, if applicable. Then, sent to the Real Estate Agents to be reviewed and approved and then to the client for review.

During this time, the closing agent will contact the buyers and sellers to discuss the closing options and confirm the time/date for closing.

Before signing, the closing agent will review the documents with each party and confirm the buyer has received the wiring instructions from the Secure Portal.

Once the necessary documents are notarized and all funds are received, disbursement will take place and copies will be available on the Secure Portal for the buyers and sellers.

We strive to make the closing process as stress-free as possible, if you ever have any questions about the closing process, feel free to contact any of our offices for personal assistance.

According to the Mortgage Bankers Association, mortgage credit availability decreased in April for the second month in a row.

According to the Mortgage Bankers Association, mortgage credit availability decreased in April for the second month in a row.

Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting said mortgage credit availability fell as lenders reacted to the jump in mortgage rates over the past two months.

With home prices still escalating. interest rates going up and lending standards tightening, can mortgage fraud be far behind?

In its Q1 2022 Quarterly Mortgage Fraud Brief, CoreLogic reported a large drop in loan volumes, combined with a subsequent decline in lower-risk refinances are driving an increase in fraud risk. Significantly, the year-over-year trend is up 15% from Q1 2021.

With interest rates on the rise, CoreLogic opined that commission-based loan officers and borrowers desperate to finalize transactions before rates go higher could be tempted to engage in riskier behaviors to get the deals done.

One of the chief lessons we learned from the 2007 mortgage debacle is the importance of being vigilant as market fundamentals become more uncertain. Perhaps this is the perfect time for a refresher course on mortgage fraud schemes for your staff.

We know now that lenders, appraisers and title agents were acutely aware of problematic transactions coming across their desks in the mid-2000s, and while many pushed back, raised red flags, and reported the abuses, the sheer volume of abuses made the eventual train wreck inevitable.

But we don’t have to go down that road this time. We can begin now to reeducate ourselves about schemes and scams out there.

According to the FBI, here are the most common types of mortgage fraud:

Lenders are much more astute at confirming the data that comes to them. Title agents are specifically educated to look for issues in the chain of title and to identify fraudulent deeds, powers of attorney or identification.

But everyone who is part of the transaction has a responsibility to be alert to questionable situations in a real estate transaction, and this may be the best time to start raising awareness with your staff.

On November 1, 2021, the FR/BAR Residential Contract for Sale and Purchase (the FR/BAR "As Is" Contract) underwent several changes reflecting an intent to level the playing field between buyers and sellers of residential property. In case you missed it, here are some notable changes. PLEASE NOTE: This is NOT a comprehensive or exhaustive view of these changes. The Contract has further updates, new riders, and other changes that you should familiarize yourself with and contact legal counsel for further information.

Section 8(b) – Loan Approval Period

Two tasks must now be completed during this period: The buyer must obtain approval for financing as described in the section (as before) with a new requirement that the buyer’s lender must receive a satisfactory appraisal before the approval period expires. This aims to prevent a low appraisal from ruining a transaction up to and including at the time of closing. It also aims to ensure that the property can return to market much sooner to find a new buyer, should funding fall through.

Make sure you’re ending the loan approval period well before the closing date!

Section 19, Standard O – Delivery Methods

Under the revised contract, methods for delivery notice have changed. They can now be delivered by fax or email, in addition to the by mail or via personal delivery options that remain in place. Other electronic delivery methods have also been deleted, such as text messaging. Texting cannot be used to provide notice under this new contract! They are unreliable in terms of providing evidence that a notice was delivered by erasure or tech ‘fails.’

Other Notable Changes Include, but are not limited to:

The definition of "Personal Property" now includes thermostats, doorbells, TV mounting hardware, and storm protection items.

FIRPTA withholding and reporting costs have been added as an item to be paid by the seller.

You can review a full breakdown the contract changes here.

In some markets, it may not yet seem like it. But even as some lenders continue to ride the refinance wave, the forecasts for the coming year are fairly aligned in agreeing that the refinance boom will be receding soon. For some, it already has. For others, maybe in a month? Three months? Five months? Obviously, we don’t really know. But it seems likely that, barring some incredibly impactful and unexpected event, we’ll be doing much more purchase business in the coming year than we will be refinance.

The forecasts also agree that volume will be high again in 2022. The downside is that, like most boom markets, the mortgage and title industry expanded to meet the historic demand we saw in 2020 and 2021. That means there are more mouths to feed. And while the proverbial “pie” is still ample, it will be smaller than the giant feast we’ve been enjoying.

So what does that mean for you?

If you’re a REALTOR or loan officer, you already know what you need to be doing. You’re shoring up your relationships, scrubbing your leads and double-checking your CRM. A competitive purchase market is built upon leads, marketing and sales. But if you are a lender, you’re probably also becoming more and more aware that 2022 will likely be more expensive for lenders. “Margin compression” may end up being the phrase of the year, and with good reason. When volume is sky high and a product lends itself naturally to streamlined production processes, we don’t talk too much about margins. But the purchase transaction takes longer to close, comes with more complications and can be costlier to produce.

So, REALTORS and lenders, the service providers you choose on the title and closing side can make a difference in a purchase market as well. Turn time is a great example. If your provider helps shave a day or two (or three) off of the closing process because it’s already positioned for efficiencies, your closing process is that much shorter as well. Your staffs are more productive as they move on to the next file or next sale. And, as an added bonus, you’re likely to have a happier borrower on your hands when the closing process is smooth and quick. Can’t hurt the repeat or referral aspect of marketing, right?

For title companies and other service providers, now is also the time to revisit your production and service processes as well. How automated are you? Are there costly, way-too-manual elements to your workflow that require more labor than your margins can bear? Outsourcing has long been a Business 101 solution for shrinking margins for a reason. It works. Simply being able to eliminate some fixed expenses for a provider able to scale its services is a classic and effective way to relieve some of the margin pressure.

This isn’t the first posting we’ll do about the coming purchase market and it likely won’t be the last. But we haven’t truly seen a more-or-less nationwide purchase-dominant market in years. Here’s the best news. All indications are that the opportunity will be there. And a little competition never hurt, right? It’s time to get prepared and have a plan!

Please fill out form below