Congrats on your new home! Now, it’s time to get prepared for your move. While there are many details to prep leading up to the big day, we’ve compiled an essential list of moving tips and things to remember based on our experiences

Take it from people who have moved numerous times and hire good movers! If it fits into your budget, we highly recommend hiring a moving company. A professional moving company knows the best way to transport your items as well as how to pack up large items to protect them during the move. However, if a moving company isn’t in your budget, recruit some awesome friends to help.

With both options, make sure to communicate clearly and often about your moving plans. This will make it less stressful for everyone. Also, it doesn’t hurt to help those who are helping you. Everyone loves pizza, right?!

This is pretty straightforward. You don’t want to get into your new home and not have any power. Make sure to call the utility companies in advance to schedule every necessity to be turned on before you arrive.

Packing can be daunting and overwhelming, but if you start as soon as you know you are moving, you can chip away at your moving tasks day by day. We’ve even created a checklist to help! We break it down by time intervals to your move date, with tips for 60-, 30-, 15- and 3-days out from your move date. Download our checklist now!

While you’re at the packing stage, we recommend decluttering. This is your opportunity to get rid of things you no longer need or use. You can give those items to friends or donate to people in need. Bonus? You’ve got less items to pack. It’s a win – win!

Unless you plan on unpacking everything the same day you move, we highly recommend creating a survival kit (or bag). Moving day is exhausting, and the last thing you want to do is search through your boxes to have your essentials handy.

Instead, you can pack an overnight bag like you would if you were traveling. Also, if you want to include some food items and entertainment, you can make sure those are all in one box. What are the things you need to survive in your new home for the next 48-72 hours (or however long you plan on taking to unpack)? Those items are what you need in your survival bag.

Safety comes first all the time. Even if your home is a new build, you should change the locks. You don’t know who or how many people have had access to the keys you were given.

It’s very GREEN and budget friendly to use what you already have as packing materials. You can wrap fragile items in sheets or use them to fill empty space in boxes. Plus, once you’re unpacked, you’ll have less trash to throw away. Just be sure to pack your daily, must-have linens in your survival kit before using them as packing supplies.

And, while we’re utilizing items we already have, how about using your luggage and other similar items as packing receptacles? You’re already taking it with you. This is your time to work smarter, not harder.

Your movers can’t read your mind and don’t have x-ray vision. Labeling each box, either with color codes or text, can help your movers know where to put your items. This is where communication comes in handy, as well. If yellow notates kitchen items, and your movers know you need all kitchen items in, you guessed it, your kitchen, they’ll know to grab all those boxes and put them together.

While your upcoming move might be overwhelming, these 7 tips will help you prepare for the big day! If you need a more in-depth checklist and guide for your move, download our moving guide today. It’s filled with checklists and tips for your moving day.

Here's a little disclaimer Aaron M. Davis, CEO of Florida Agency Network, likes to give when speaking on title insurance in Florida.

"Florida, where a judgment can attach to a piece of property simply by filing a document with the clerk, and the name doesn’t even have to be spelled correctly.

Florida, where the county may or may not have to actually FILE an enforcement action on a property for it to attach, as long as they were thinking about doing it at some time.

Florida, where an unlicensed contractor can pull a permit on a house to put on a new roof, not close a permit, and 10 years later you have to hire a licensed contractor to go back, fix the prior’s work, and close the permit.

Florida, were the seller picks the title agent or attorney, and pays for title insurance, but only depending on the county you are in. Or, even depending on what PART of a county you're in."

Across the country, there are 37 states where the buyer picks/pays for title and 12 states where it’s customary for the seller to do so.

Where the Buyer picks in:

Then, seller picks in the majority of the other areas...

HUH???

Title scholars, settlement experts, underwriting counsel, and others who still say things like “HUD statements, policies in triplicate, dot matrix printers, and white out," have contemplated WHY this occurs in Florida.

Title scholars, settlement experts, underwriting counsel, and others who still say things like “HUD statements, policies in triplicate, dot matrix printers, and white out," have contemplated WHY this occurs in Florida.

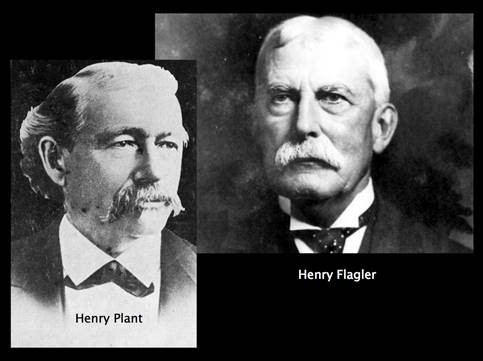

Well, Aaron has figured it out! We can blame two men named Henry. (Of course, it's a man's fault.)

These two gentlemen were railroad tycoons who ventured deep into Florida. The areas they ended up in became tourist destinations, with great beaches, water access, and lots of construction opportunities. Plant’s rail line landed in Sarasota, and Flagler’s line had a few stop down the East coast of Florida, landing in Palm Beach and Miami.

These two gentlemen were railroad tycoons who ventured deep into Florida. The areas they ended up in became tourist destinations, with great beaches, water access, and lots of construction opportunities. Plant’s rail line landed in Sarasota, and Flagler’s line had a few stop down the East coast of Florida, landing in Palm Beach and Miami.

With all those tourists and construction came the attorneys who handled those transactions, several of who previously resided in New York. And in New York, you guessed it - it’s customary for the buyer to pick and pay for title.

As for coastal areas, well, those buyers are typically wealthy, so we guess they just get stuck with the bill.

You may not know it, but your email and web browsing habits may be inadvertently helping the “bad guys” take your personal information, or nonpublic private information (NPPI). Hackers are targeting the real estate industry by utilizing sophisticated techniques and technology to hack into existing email threads and redirect the communication, and far worse, the funds, elsewhere. For real estate agents and their clients, this could mean a big payday for hackers, as well as an enormous headache, and possibly legal action, for agents and their clients.

To protect you and your clients, Aaron M. Davis, CEO of Florida Agency Network (FAN), has compiled a list of actions agents should take to help prevent exposing themselves and their clients to a potential hacking situation.

Hackers have infiltrated our industry and figured out how to create chaos. The most effective way to fight back is to educate yourself and partner with companies that monitor and secure their networks.

Through FAN’s partner, Premier Data Services, agencies within the Network stay up-to-date on compliance initiatives and policies. Each agency hosted by Premier Data Services is SOC 2 compliant, and is audited and verified by a third-party specialist organization, 360Advanced. FAN and its agencies gladly take on the responsibility of not only insuring the title to your home, but also in safeguarding your NPPI.

If you’re selling, don’t do these things - take some notes from the video!

1. Don’t Sell Before The House Is Ready.

If it doesn’t present well, it won’t sell well.

2. Don’t Over-Improve

People buy houses in neighborhoods.

If yours is so “improved” that it sticks out you’re hurting your chances at selling.

3. Hire Wrong

Make your agent choice for business reasons.

Personal relationships matter, but experience and expertise will determine financial success in your sale.

4. Don’t Hide Anything

Covering up or ‘failing to mention’ real problems doesn’t work.

State disclosure laws are strict and you can be sued after the sale for anything that should have been made clear.

5. Don’t Rush

You should know about your mortgage, including pre-payment penalties your market conditions and trends and your options for your next home before jumping on the market.

6. Don’t Get Too Emotional

Your attachment to your house and your own financial needs

don’t really matter in the transaction.

If you can’t set them aside the sale won’t go as you’d like it to.

Remember - it was your home but to the buyer it’s as a house.

As we show you in this video, start several months before the property is made available. Look through the eyes of a buyer

Ask yourself - or a friend, If you were buying this house what would you want to see?

The goal is to show a home that looks good makes the most of its assets like space and location and attracts as many buyers and as much demand as possible.

Allow yourself enough lead time - not just a day or two - to make the most of the sale. And get help from a real estate agent - early.

You’ll see some pictures in this video to help you remember later, but the first step in securing a loan is to complete a loan application.

To do so, you'll need the following information.

During the application process, the lender will order a report on your credit history and a professional appraisal of the property you want to purchase. The application process typically takes between 1-6 weeks.

Equity is the value YOU own in property such as a house. It’s the difference between what’s OWED and what the property is WORTH in the current market.

The example this video shows - you have a house worth $300,000 today and you owe the bank $200,000. Your equity would be $100,000.

If the house is valued at $500,000 in five years, and you still owe $150,000 your equity will be $350,000.

Equity grows if the property value goes up or if the amount owed goes down. The key thing to remember, simple as it sounds, is that you "own" increases in value. The bank's loan doesn't go up if the home's value goes up.

Equity in a home can be used as collateral for loans but a house is not a piggy bank. Home equity can become a key financial asset over time; treat it wisely.

The Prime Lending Rate - sometimes just called “Prime” - is the interest rate that banks charge each other for overnight loans. Some consumer rates - like ARMs - are set in relation to Prime.

In the US, Prime is affected by the Federal Reserve lending rate to banks; historically, Prime is about 3 percent above the Fed rate.

The video shows an example.

ARM rates are frequently defined as “% above Prime” - that gap is usually called the “margin” or “spread.” Just remember those 3 layers in Prime: Federal Reserve Bank A Bank B And finally, YOUR rate.

This video tells you about it all. PMI stands for Private Mortgage Insurance or Insurer. These are privately-owned companies that provide mortgage insurance. They offer both standard and special affordable programs for borrowers.

These companies provide guidelines to lenders that detail the types of loans they will insure. Lenders use these guidelines to determine borrower eligibility.

PMI's usually have stricter qualifying ratios and larger down payment requirements than the FHA but their premiums are often lower and they insure loans that exceed the FHA limit.

Please fill out form below