There’s no hiding from it at this point. We’ve entered a significant market downturn and the likelihood of recession is high. But, as we’ve said repeatedly, that doesn’t mean the world is ending, either. It’s been a while, but we’ve weathered numerous down cycles in the past. And as far as we’re aware, no economists are predicting anything close to what happened in 2008. If anything, it’s still likely we’ll see around $2 trillion in mortgage origination volume, which means there will be very real opportunities for title agents to do business and even succeed in 2023.

There’s no hiding from it at this point. We’ve entered a significant market downturn and the likelihood of recession is high. But, as we’ve said repeatedly, that doesn’t mean the world is ending, either. It’s been a while, but we’ve weathered numerous down cycles in the past. And as far as we’re aware, no economists are predicting anything close to what happened in 2008. If anything, it’s still likely we’ll see around $2 trillion in mortgage origination volume, which means there will be very real opportunities for title agents to do business and even succeed in 2023.

Prepared title agencies, that is.

Our own Aaron Davis was recently published in Housing Wire on this very topic. (Registration Required) He experienced the crash of 2008 and vividly remembers tracking which lenders had become insolvent in order to determine which of the agency’s closings would be “funded” by checks about to bounce. Challenging times drive successful leaders to find new and innovative ways to get things done. We believe that will be the case again over the next year or two.

Aaron suggests having a carefully considered capitalization plan in place…and do it yesterday. Now is not the time to be solely dependent upon a fresh capital raise. And yes, even when order volume is down, it’s still time to set something, anything, aside for future reinvestment into the business.

It’s also quite understandable that many title businesses may need to undertake some painful cost-cutting decisions. Aaron suggests that, while cost cutting can be a necessary, if undesirable, tool when a market turns down, he reminds decision makers and owners to think through those cuts very carefully. Sometimes, a business cuts unnecessarily deeply, to the point that it impairs or even irretrievably damages its own client base and brand.

Be sure to have a look at the entire article over on Housing Wire. The point is that, yes, times are becoming challenging, but the world is not ending. Title business owners who take a step back and review the big picture may even find that the innovation and discipline driven by a decline in order volume could lead to greater success during the next market up-tick.

Closing on your new home can be both exciting and confusing. There are many factors to consider throughout the process. One item to consider is how you’ll hold the title of your new Florida home. Buyers can easily overlook this detail during the closing process, which can be detrimental if you decide to sell your home.

Your title agent can answer general questions or direct you to their real estate attorney to provide more information and answer questions. Here are the ways for you to hold title to real estate in Florida:

For a single, unmarried home buyer, this option is the most popular way to hold the title to their home. It’s simple and straight forward. It just means the title will be held solely under their name. Married individuals can hold title as sole ownership as well. For example, with an investment property, one individual may not want any ownership in the property. In this case, that spouse will have the Deed drafted for the property showing only one person holding the title. With this option, you may not receive any special tax breaks or other advantages of holding title in sole ownership. If the sole owner dies, any property held this way may be subject to probate court proceedings, which cost money and takes time.

With this option, each spouse owns an equal portion of the property for as long as they are both alive and legally married. Each spouse’s interest passes to the other upon death. This option also has some level of protection, in that a judgement against one spouse may not attach to the property.

Each tenant owns an undivided pro rata share of the property and must take ownership at the same time. Also, each tenant will have a right of survivorship, so if one of them passes away, their share will transfer to the surviving tenant (or tenants). The will of the tenant who passed away has no impact on the joint tenancy property. Joint tenancy also allows the surviving tenants to avoid probate expenses and delays when one of the tenants dies. The surviving tenants need to record an affidavit and provide a death certificate to clear the title

If there are two or more buyers, the individuals can opt to hold title as tenants in common. Tenancy in common is a popular option for individuals who aren’t married or are investors, friends, or family. As tenants in common, each tenant (individual) owns a certain percentage of the property, typically equal shares among the owners. In the event any owner should pass, their interest will vest in their estate or heirs at law. Their interest will not pass to survivors. The property will be subject to probate court expenses and delays.

Choosing the most beneficial way to take title is often overlooked by buyers. However, this step is critical to your closing transaction and situations later down the road.

It’s crucial to speak with a real estate attorney when deciding how to hold title on your Florida real estate property. We have in-house attorneys with years of experience in Florida real estate. By choosing to close with any of Florida Agency Network’s title agencies, you and your agent have access to those attorneys, and many more resources throughout your closing transaction.

In a world full of left-swipe worthy businesses, it’s difficult to know which title insurance company to choose for your transaction. Before you swipe right and do business with the wrong title insurance company, here are some things to consider before you choose your perfect match in a title company.

We see it time and time again, a title company seems to pop up overnight and is ready to do business. However, can you trust the work that is being done throughout your transaction? How do you know your private information is protected?

Find out how long the title insurance company has been doing business. A title insurance company that's been in the industry for a longer period knows the ins and outs and can speak to common questions or issues that come up, with ease. A title insurance company’s longevity shows efficient and effective processes in place. And with experience comes stability and peace of mind for all those experiencing the closing process. That leads to the next point.

Life can get busy. Going out of your way to get to, or handle anything thing for your closing can become a hassle. Look for a title insurance company that has multiple locations or can accommodate you during the closing process. Do they offer mobile closing or mobile notary services to their clients? Do they offer e-closings or remote online notaries (RON)? These are just a few of the points you'll want to discuss with your title insurance company.

"A great captain is great only if he has a great team."

Your title insurance company is only as good as the team they provide to their clients. Choosing a title insurance company with a large, experienced, and dedicated staff are the qualities you want in your closing team. It's critical that your closing team has the correct licensing and educational background to get you through the entire closing process.

Don't forget to inquire about the title insurances company's support; Who do they underwrite with? What type of errors & omissions (E&O) policy do they carry? This may all sound foreign to you as a buyer or seller, but this information shows the strength of a title company when difficult situations arise.

A title company with longevity and experience has built a reputation within the real estate industry. You should place your trust in a title company that is the leader in customer and employee satisfaction.

Ask your real estate professional about their experience(s) with the title insurance company. Don't forget to do your online research. Read through online reviews on their social pages, Google and more. It's common to have a problem here or there, but is there a trend your finding with each customer experience?

There are many points to consider when swiping right on your perfect title insurance company. Florida Agency Network brands not only can close your real estate transaction at any of the many locations throughout the State of Florida, but also close your transaction at any place convenient to you with mobile notaries, e-closing and remote online notarization (RON) partners, FAN brands have the large footprint you want to have on your side.

Our closing staff has many years of experience in title insurance and closings. We also work with several underwriters which gives us the resources to close deals other title insurance companies cannot.

As a new homeowner, protecting your investment is at the top of the “to-do” list. From buying security systems to obtaining homeowners insurance, there are countless ways to protect your investment. Obtaining title insurance through an Owner’s Title Insurance Policy, insures your homeownership rights aren’t affected after you’ve purchased your home.

Here is a list of a few examples that can come up after your home purchase.

For buyers, one of the most important ways to protect your property rights is getting an owner’s title insurance policy, or title insurance. Agencies within The Florida Agency Network provide homeowners with the peace of mind and the smooth closing they deserve.

Contact any of our offices for more information on our closing services and how we can help you during the closing process.

Here's a little disclaimer Aaron M. Davis, CEO of Florida Agency Network, likes to give when speaking on title insurance in Florida.

"Florida, where a judgment can attach to a piece of property simply by filing a document with the clerk, and the name doesn’t even have to be spelled correctly.

Florida, where the county may or may not have to actually FILE an enforcement action on a property for it to attach, as long as they were thinking about doing it at some time.

Florida, where an unlicensed contractor can pull a permit on a house to put on a new roof, not close a permit, and 10 years later you have to hire a licensed contractor to go back, fix the prior’s work, and close the permit.

Florida, were the seller picks the title agent or attorney, and pays for title insurance, but only depending on the county you are in. Or, even depending on what PART of a county you're in."

Across the country, there are 37 states where the buyer picks/pays for title and 12 states where it’s customary for the seller to do so.

Where the Buyer picks in:

Then, seller picks in the majority of the other areas...

HUH???

Title scholars, settlement experts, underwriting counsel, and others who still say things like “HUD statements, policies in triplicate, dot matrix printers, and white out," have contemplated WHY this occurs in Florida.

Title scholars, settlement experts, underwriting counsel, and others who still say things like “HUD statements, policies in triplicate, dot matrix printers, and white out," have contemplated WHY this occurs in Florida.

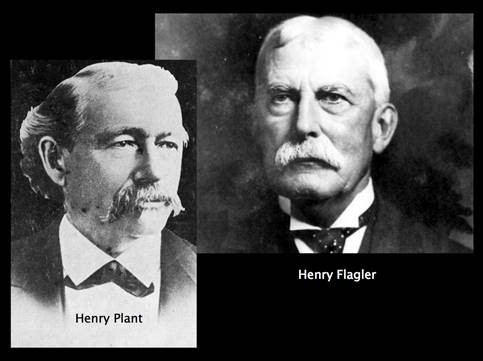

Well, Aaron has figured it out! We can blame two men named Henry. (Of course, it's a man's fault.)

These two gentlemen were railroad tycoons who ventured deep into Florida. The areas they ended up in became tourist destinations, with great beaches, water access, and lots of construction opportunities. Plant’s rail line landed in Sarasota, and Flagler’s line had a few stop down the East coast of Florida, landing in Palm Beach and Miami.

These two gentlemen were railroad tycoons who ventured deep into Florida. The areas they ended up in became tourist destinations, with great beaches, water access, and lots of construction opportunities. Plant’s rail line landed in Sarasota, and Flagler’s line had a few stop down the East coast of Florida, landing in Palm Beach and Miami.

With all those tourists and construction came the attorneys who handled those transactions, several of who previously resided in New York. And in New York, you guessed it - it’s customary for the buyer to pick and pay for title.

As for coastal areas, well, those buyers are typically wealthy, so we guess they just get stuck with the bill.

Source: Timeline > Consumer Financial Protection Bureau

Here’s a full timeline of how we created the Loan Estimate and Closing Disclosure forms, part of our Know Before You Owe: Mortgages project. It’s a look back at our effort to make mortgage disclosures simpler and more effective, with the input of the people who will actually use them.

You can also return to the main page to view an interactive timeline.

The new law required the CFPB to combine the Truth in Lending and Real Estate Settlement Procedures Act disclosures.

The event brought together consumer advocates, industry, marketers, and more to discuss CFPB implementation of the combined disclosures.

Starting with the legal requirements and the consumer in mind, we began sketching prototype forms for testing.

During this process, the team discussed preliminary issues and ideas about mortgage disclosures. This session set the context for the disclosures and was a starting point for their development. The team continued to develop these issues and ideas over more than a year during the development process.

We posted the first two prototype loan estimates. We asked consumers and industry to examine them and tell us what worked and what didn’t. We repeated this process for several future rounds. Over the course of the next ten months, people submitted more than 27,000 comments.

We sat down with consumers, lenders, and brokers to examine the first set of loan estimate prototypes to test two different graphic design approaches.

Consumers and industry participants worked with prototypes with lump sum closing costs and prototypes with itemized closing costs.

Again, we asked testing participants to work with prototypes with lump sum closing costs and itemized closing costs.

Another round of closing cost tests, as we presented participants with one disclosure that had the two-column design from previous rounds and another that used new graphic presentations of the costs.

In this round, we presented closing costs in the itemized format and worked on a table that shows how payments change over time.

We began testing closing disclosures. Both designs included HUD-1-style numbering for closing details, but two different ways of presenting other costs and Truth in Lending information.

One form continued to use the HUD-1 style numbered closing cost details; the other was formatted more like the Loan Estimate, carrying over the Cash to Close table and no line numbers.

In this round, we settled on prototypes formatted like the Loan Estimate, but one included line numbers and the other didn’t. We also began testing the Loan Estimate with the Closing Disclosure.

Prototype A

Prototype B

Prototype C

Participants reviewed one Loan Estimate and one Closing Disclosure (with line numbers) to see how well they worked together.

A panel of representatives from the CFPB, the Small Business Administration (SBA), and the Office of Management and Budget (OMB) considered the potential impact of the proposals under consideration on small businesses that will provide the mortgage disclosures.

The panel met with small businesses and asked for their feedback on the impacts of various proposals the CFPB is considering. This feedback is summarized in the panel’s report.

(Note: Link to large PDF file.)

We conducted one final round of testing to confirm that some modifications from the last round work for consumers.

Prototype A

Prototype B

Prototype C

The CFPB released a Notice of Proposed Rulemaking. The notice proposed a new rule to implement the combined mortgage disclosures and requested your comments on the proposal.

Between the public comment period and other information for the record, the CFPB reviewed nearly 3,000 comments. These comments helped us improve the disclosures and the final rule.

We conducted qualitative consumer testing on Spanish language versions of the proposed disclosures. We tested in three cities: Arlington, Va. (October 11-12); Phoenix, Az. (November 14-15); and Miami, Fla. (December 12-13).

With the help of Kleimann Communication Group, the contractor who helped us throughout the testing process, we conducted a quantitative study of the new forms with 858 consumers in 20 locations across the country. By nearly every measure, the study showed that the new forms offer a statistically significant improvement over the existing forms.

In response to comments, we developed and tested different versions of the disclosures for refinance loans, which we tested for three rounds. (In our last round, we tested a modification for both purchases and refinances.) We also did one more round of Spanish language testing for the refinance versions. The modified disclosures tested well and are the ones included in the final rule.

The CFPB issues a Final Rule. The final rule creates new integrated mortgage disclosures and details the requirements for using them. The rule is effective for mortgage applications received starting August 1, 2015.

The CFPB issues a final rule moving the effective date to October 3, 2015.

After October 3, 2015 you will no longer be receiving a HUD-1 settlement statement before consummation of a closed-end credit transaction secured by real property.

Say what?!?!

That's right, I just said consummation of a closed-end credit transaction and no more HUD. There is new jargon to go along with the new, easy-to-read, consumer friendly, disclosures.

Bon Voyage HUD!

Take a peek at the new disclosures!

www.closing-disclosure.com

Stay on top of your game by familiarizing yourself with the general requirements that are going change in regards to the Good-Faith Estimate when the new TILA-RESPA Integrated Disclosure (TRID) rule goes into effect.

First of all, it is no longer going to be called a Good-Faith Estimate but will then be identified as a Loan Estimate.

Guess what?!?!

The jargon isn't the only thing that is changing! The new disclosure carries with it some timing deadlines as well as a new look and lay out to the forms used instead of the familiar GFE.

The creditor, formally known as the lender, is required to provide all consumers of closed-end transactions secured by real property with a good-faith estimate of credit costs and transaction terms.

Mortgage brokers or creditors may provide the Loan Estimate to the consumer when the mortgage broker receives the consumer's completed application and must be provided no later than 3 business days after the completed application has been turned in.

This new TILA-RESPA form integrates and replaces the current RESPA GFE and the initial TIL for these transaction types. Creditors must issue a revised Loan Estimate only in situations where changed circumstances resulted in increased charges.

These general requirement changes are meant to help better inform, protect and serve the consumer. The Florida Agency Network is ready to guide the industry through these changes and looks forward to partnering with you to streamline the process.

Schedule a Training Class

Please fill out form below