HURRICANE SEASON

Each year, the country is hit with hurricanes, tornadoes, hailstorms, super storms, flooding, and more. With hurricane season running from June 1st to November 30th, coastal and inland region homeowners must prepare for potential storms annually. Of course, you have insurance to help you recover. But knowing and doing a few things now—while the weather’s fair—can help you and your family stay safe and help you protect your property if the unexpected happens:

• Stock up on important items such as canned goods, water, pet food, paper goods, flashlights & batteries with a battery-operated radio.

• Clean up around your property! Trim trees and shrubs, store outside items such as grills, boats, trailers securely – and yes storing the lawn furniture in the pool can work (if it’s rust proof!)

• Be sure all important documents are stored in a waterproof safe, in the cloud, or in a secure portal online. These documents should include your Homeowners Insurance policy, survey, marriage license, wills, social security card, title policy, etc.

• Consider Flood Insurance, even if you are not in a flood zone. Be sure to purchase early – it can take 30+ days for the insurance company to finalize your policy. Take photos of the property, inside and out, prior to the storm.

What if you’re involved in a real estate transaction during hurricane season? Consider signing contracts and binding your insurance earlier than normal, and know your closings options in case of evacuation. Our options include, but are not limited to, Remote Online Notarization (RON), Mobile Notary services at your location, or a Traditional Closing (in-person at the office).

We’ve created a downloadable PDF of our tips for you and your clients. For resources by county on flood and evacuation zones, visit www.floridadisaster.org/knowyourzone.

For more information reach out to your account executive or contact one of our locations: https://flagency.net/locations/

Recently, Aaron Davis had an article published on the ALTA website regarding the possibility of recent acquiring of title companies during a recent surge of mergers and acquisitions.

Below is a copy of the article, or ALTA members can read it here: https://bit.ly/34vg3h3

So You’ve Acquired a Title Business. Now What?

May 25, 2021 by Aaron Davis

It’s been an active year for mergers and acquisitions (M&A) in the settlement services space, to the surprise of nearly no one. 2020 was a year of record order volume for the title industry, leaving many firms flush with cash. While 2021 has been a year of opportunity in a rising purchase market, many economists forecast an imminent decline in refinance transactions. Regardless of what we’re currently seeing, it will be nearly impossible to repeat the historic spike seen last year. The likelihood is that 2021 will be very good—but not as good as 2020. Title agencies and settlement services firms will be forced to compete for market share.

This unusual turn sequence of events in the market has left many title companies facing some key strategic choices. More than a few, understanding that the market dynamic is shifting to one of increased competition, have plotted a course based on M&A: making strategic investments to increase their geographic and/or market footprints. Others, aware that, as good as 2021 may be, it won’t be 2020, are looking to sell high or "cash in." It’s the perfect environment for M&A activity.

For the title agent or owner seeking to grow, the due diligence and valuation process is critical to the success of the strategy. But often overlooked in the larger process is what comes after the contracts are signed. For many, the real work begins once multiple offices and firms become one in name. A lot of thought, work and, yes, capital will still have to be injected into the process of integrating the new entity and positioning it to operate efficiently and profitably. What follows are a few of the things some acquiring businesses don’t always fully consider once they’ve received the proverbial keys to their new offices.

While the M&A due diligence process includes a pretty thorough review of the business being acquired, there are still aspects of the acquired business the new owner or owners may have to learn about after the ink on the contract has dried. The new owner is probably well aware of the production system being used and, if it’s a title agency, the underwriters they work with. But many times, the acquiring agent or owner doesn’t have a thorough understanding of the way that company does business at a granular level. For example, if the staff of an agency is used to handling the post-closing process for their own files, incorporating that title knowledgeable staff into a process-oriented business where the curative department only does curative while closers only do closings may be a challenge (although the thought of no longer having to handle post-closing might not be disagreeable to the new staff!). If the previous owner was an incredibly hands-on manager, a new owner who prefers to delegate or allow more freedom to a new staff could also, in some ways, provide a challenge as the two cultures blend.

Acquiring owners are likely very familiar with the geographical market or markets in which they operate their existing firms. But if the company and offices being acquired are outside of those familiar markets, those owners may need to rely on some of the professionals from the acquired companies as they acclimate to that new market. Anything from demographics or custom to, of course, regulatory differences can have a big impact on the way an acquiring firm does business day to day. It’s advisable to have a plan (and a contingency plan) that will acclimate the new owner and key personnel unfamiliar with the new market to the unique characteristics of that market. It could save a surprising amount of time, energy and, of course, money, in the long run.

Acquiring owners may also believe they have performed adequate due diligence as to the technology and systems being inherited with the new offices. However, if the intention is to replace a production system with a different technology, those owners may be surprised by the need to keep at least one license for the system being replaced—and the cost. You see, existing clients will not care to again provide the sensitive data that will otherwise be lost in the archives of the old platform. Acquiring owners should plan to make a little investment in maintaining one license in order to have access to existing data for inherited customers.

In fact, one thing that seems to surprise a number of title business owners engaging in an M&A strategy is the investment required after the acquisition. The cost of training, tech integrations or outright replacement and even hiring or retraining often outpaces the conservative estimates of the acquiring owners. It’s also highly advisable to dig deeply into the hidden costs associated with the business acquired. Little things such as long-term contracts with 3rd party service providers or even copier leases can become unexpected costs when the acquiring owner seeks to change the way the little things are done. Another fairly common surprise may be the requirements of a pre-existing IT services or hosting contract, which could delay software installations or a full-on integration of the company-wide network or, even worse, lead to invoices for services that aren’t even being used.

Finally, there is the cost of time when integrating two office cultures. Acquiring owners should be prepared to spend time getting to know and understand the existing staff—unless they are planning the costly and time-consuming task of replacing them. It’s human nature for the professionals in an acquired business to be anxious about their job security. Some may even proactively begin to seek new employment elsewhere. A major mistake made by acquiring owners is to assume those employees can be quickly replaced (or integrated) without impacting that office’s production. The new owners who seem to have the smoothest integrations after acquisition are the ones who invest the time and resources into understanding—and being accessible to—the professionals associated with the acquired business.

Engaging in an M&A strategy is a proven means of successfully growing market share, which is imperative in a purchase market. But it’s not a given that simply making the acquisition will double or triple a business’ revenue and order volume. When insufficient planning and attention are given to the post-acquisition integration process, a merger or acquisition can have disastrous effects—right up to dragging the acquiring business itself into crisis. By taking the time and effort beforehand to carefully plot a post-acquisition strategy, the acquiring owner will be much more likely to reap the maximum benefits of the overall strategy.

Aaron Davis is chief executive officer of Florida Agency Network and AMD Enterprises.

Contact ALTA at 202-296-3671 or communications@alta.org.

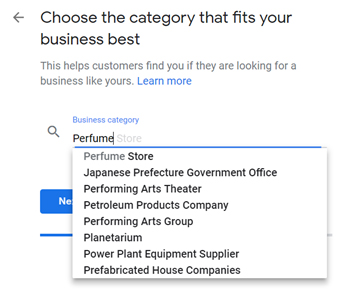

Visibility is key in the real estate industry. Are you searching for a way to boost your visibility in mere minutes at zero cost to you? Check out Google My Business!

Google My Business is a free tool that will give your brand and reputation a rocket boost over your competition. We rely on Google’s business listings to be a trusted source for business information and reviews. Why not use it as a marketing tool for yourself and be the first to come up in a Google search for business information and reviews? At no cost!

To begin the setup, here are few things you need to know:

What’s Next?

Now that you’ve officially verified your listing, it’s time to optimize your Google My Business account by adding photos and videos, writing a compelling business description, encouraging your loyal customers to “Follow” you on Google Maps, and starting to request and manage your Google Reviews.

Have you updated your FANAgentOne app yet? If you haven't, its time to get moving! You're missing out on fast answers for your clients with market specific title fees, closing cost estimates in real time, and more.

Here are the new and exciting updates:

But the best part... all of this in the palm of your hand!

NEW to FanAGENT One? Check out these videos to learn more:

You may have used our FANAgentOne app in the past, but with so many new feature that YOU'VE asked for - you have to take another look. Still not sure? Check out this PDF of the new features, or check out out by downloading the app at www.fanagentapp.com.

It’s the season of love, and what better way to celebrate than with gifts? We’re not talking the boring chocolates and flowers type of thing. No, no, no! Home is where the heart is, so why not focus on a gift for a home?

It’s the season of love, and what better way to celebrate than with gifts? We’re not talking the boring chocolates and flowers type of thing. No, no, no! Home is where the heart is, so why not focus on a gift for a home?

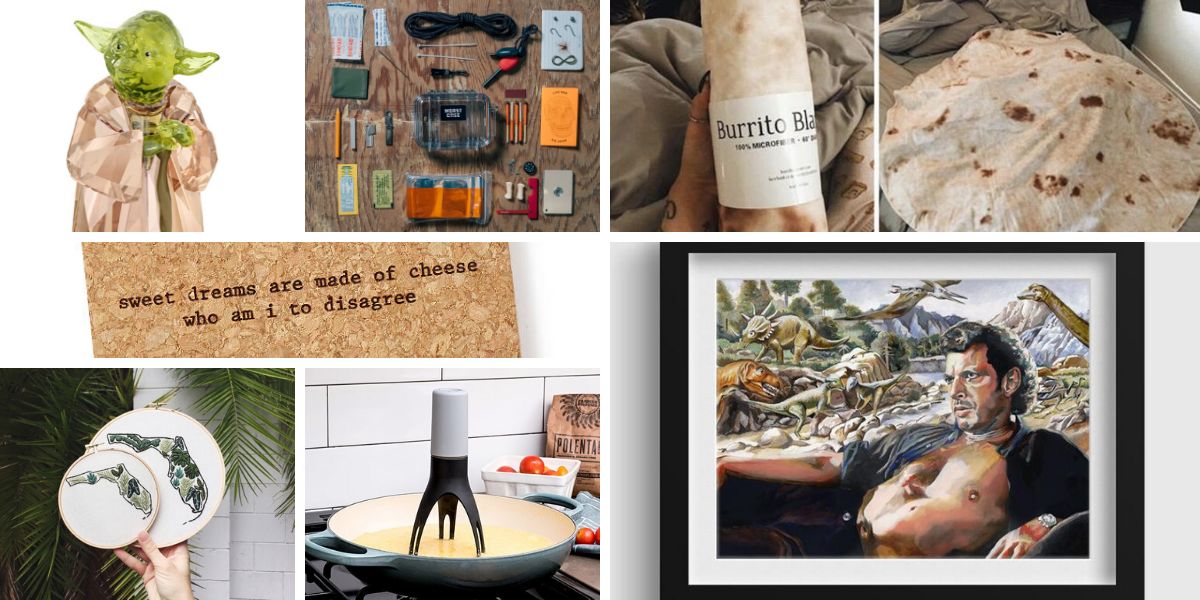

We’ve come up with a shopping guide that includes unique – and quirky – gifts to get for someone you love, especially if that someone is yourself!

One of our favorite past times is singing the wrong lyrics to songs. Why not spread the joy alongside house guests with these Mistaken Lyric Coasters?

Take “Suzy/Sam Homemaker” to the next level with this Automatic Pan Stirrer with Timer. Never worry about continuously stirring the sauce and free up your hands to prep other items for your recipe. Or, go ahead and get back to your Netflix binge while the sauce cooks. (We won’t be held liable for any burnt sauces, though.)

Nothing says “I love Florida” more than Florida-themed embroidery. This botanical creation shows others the pride you or your loved one has for the State of Florida. And, it gives the opportunity to explain that not everyone in Florida is like “Florida Man.”

First-aid kits? No, you need The Worst Case kit. (Well, keep the first-aid kit too!) This carefully crafted survival kit is everything someone would need if there were ever a zombie apocalypse, an opportunity to be on Survivor, or you find yourself up THAT creek without a paddle.

Ever wanted to be wrapped like a burrito and left alone on the couch for a few hours? Well, now you can! Take Taco Tuesday to the next level in a Burrito Blanket. With micro-fiber fleece, this blanket will keep you or your loved one warm and cozy!

Because who doesn’t want a shirtless oil painting of Jeff Goldblum contemplating life while surrounded by dinosaurs?

Yeah, Baby Yoda is cute and all. But, have you seen a Swarovski Crystal Master Yoda figurine? Step up you or your loved one’s Star Wars collection with this classy Jedi Master.

Here are some very basic instructions on how to access your county’s flood maps:

Taken from Pasco County’s incredibly helpful website:

Zones designated as AE, A, AH or AO Zone. These properties have a 1 percent chance of flooding in any year and a 26 percent chance of flooding over the life of a 30-year mortgage.

VE or V Zones. These properties also have a 1 percent chance of flooding in any year and also face hazards associated with coastal storm waves.

High-risk areas are called Special Flood Hazard Areas, and flood insurance is mandatory for most mortgage holders.

Low or Moderate Flood Risk

Shaded X Zone. These properties are outside the high-risk zones. The risk is reduced but not removed.

X Zone. These properties are in an area of lower risk.

Lower-cost preferred rate flood insurance policies (known as Preferred Risk Policies) are often an option in these areas.

We hope you can make it out to the RE-GRAND OPENING of our South Tampa office!

Wednesday Feb. 26 from 4-6PM @ 3410 Henderson Blvd.

It's deja vu all over again for struggling Florida homeowners: The massive tax break that saved them tens of thousands of dollars has once again expired.

Underwater homeowners whose lenders let them sell their home for less than they owed have not had to pay taxes on that debt thanks to a law passed shortly after the housing bubble burst.

The Mortgage Forgiveness Debt Relief Act has been extended twice since 2007, including last year. But its expiration Dec. 31 could mean a rude awakening for homeowners come tax time.

Florida houses more than 1 million of the 6 million underwater mortgages nationwide. Even with rising home prices, about 30 percent of Tampa Bay's 600,000 outstanding loans remain underwater.

Those homeowners, many of whom bought at inflated prices during the housing boom, could ask the bank for a short sale that would let them move and dodge their debt.

But even if the bank forgave the debt, they would still be responsible for paying taxes on what is effectively an increase in their income. A short sale of $100,000 less than the homeowner's mortgage debt could, in a 25 percent tax bracket, mean a $25,000 surprise in taxes.

"These are clients with true hardships who still don't have jobs, still aren't able to find work," said Beth Cromwell, a short-sale processor for Hillsborough Title. "They're running out of options."

And it's not just short sellers. Foreclosed homeowners would owe taxes on what they failed to pay on their mortgage. Even homeowners offered mortgage help, like loan modifications or principal forgiveness, would be on the hook for taxes on what was cut.

Lawmakers could discuss an extension this month alongside dozens of other expired tax breaks. Pending bills now in Congress would extend the tax break through 2015.

Realtors short-sold 6,700 Tampa Bay homes, townhomes and condos last year, listing data show, and more than 1,500 are now listed for short sale.

Up to $2 million of a homeowner's forgiven debt qualifies for the tax break. The extension last year saved taxpayers across the country $1.3 billion, federal data show.

Housing advocates said the expired tax break will hurt those least able to afford more in taxes. Agents for some distressed homeowners attempted to rush through short sales last year to dodge the "phantom income" tax bill.

Many distressed homeowners can dodge the mortgage debt taxes if they prove to the IRS they are insolvent, owing more in debts than what they own in assets. That can be a saving grace for short sellers today who are in deep financial trouble.

"Most people who are doing (short sales) now aren't the strategic defaulters," said Keller Williams agent Steve Capen. "They have true hardships, and they usually will be insolvent at the time of closing."

Florida Attorney General Pam Bondi and 41 other attorneys general last month called on lawmakers to extend the relief, saying that, even with improvements to home prices and equity, "we are still not where we need to be."

"This relief is crucial to both the homeowners struggling to regain their financial footing and to the battered housing market whose recovery is slow and still uncertain," they wrote.

By: Drew Harwell of the Tampa Bay Times

We had a roarin' good time at the juice joint! Thank's TBBA for putting on such a fun event. A big CONGRATS to HT's very own Cathy Trongeau for being awarded Title Insurance Closer/Salesperson Of The Year.

Please fill out form below