As with most things in life, everything starts with a vision.

“In the world of real estate settlement services, it’s a vision to buy, refinance, and sell a house on a tablet device. No pens. No paper. No rubber-stamped notary seal. No 100’s of pieces of paper to be purchased, printed, signed, shipped and scanned. Oh, and shredded, who can forget shredding? Don’t get me started,” says Aaron M. Davis, CEO of Florida Agency Network (FAN).

For the world of real estate closings, the vision has been for years to transform an industry’s archaic processes through innovation and new technology. Aaron has made FAN’s purpose to innovate and blaze the path for homeownership to become more seamless, paperless, and less cumbersome for the consumer. His passion for revolutionizing the title insurance industry started decades ago, sitting in his mother’s title agency in Plant City, Florida.

“I remember the days of hand balancing HUD statements. Policies in triplicate form. Our first fax machine, our first desktop computers, Novell servers, dial-up modems, and paper. Lots and lots of paper. 200 pieces of paper per file, 30 files per storage box, and lugging boxes of files in and out of storage.”

Settlement has come light years from those days, however one piece has been missing. Remote Online Notarization, or RON for short. The ability to interface remotely via safe, online portal, digitally signing documents, and affixation of the electronic notary seal, all on a tablet device.

Pat Kinsel started Notarize because he had one too many bad notary experiences. In his case, the last straw was a notary agent who forgot to sign his document just before he went on vacation. He didn’t learn of the error until he was gone. Pat knew “there has to be a better way!”

Developing that better way required a sharp focus on innovating both in the areas of technology and public policy. In researching the process, Pat discovered the Commonwealth of Virginia had passed a law in 2011 to become the first state to allow remote electronic notarization, and all 50 states must recognize Virginia’s ability to transact business in this new way. Building upon these policies, and with cooperation from the Commonwealth of Virginia, Pat and his team have spent the past years developing an amazing product to fundamentally transform the notary process for consumers, businesses, and agents. Technology and policy have converged, and Notarize is bringing notary into the 21st Century.

When Aaron met the team at Notarize in mid-2017 and demoed their product, he knew he had just witnessed the missing piece to the puzzle, and the future of real estate settlement: Paperless, convenient, efficient, and best of all, secure.

Fast forward to today, thanks to a partnership and friendship with Pat Kinsel and Adam Pase of Notarize, FAN could collaborate with a company whose vision and innovative pursuit in the online closing space is revolutionizing the real estate closing process. One final element in the equation came down to the backing from Westcor Land Title Insurance. With Westcor’s support and Notarize’s technology, FAN conducted its first fully-digital, 100% paperless, remote online notarization closing in March 2018.

The vision didn’t stop there. “After completing our first fully-digital purchase transaction using an online notary earlier, we knew the next step would be utilizing the technology for a refinance transaction,” said Aaron.

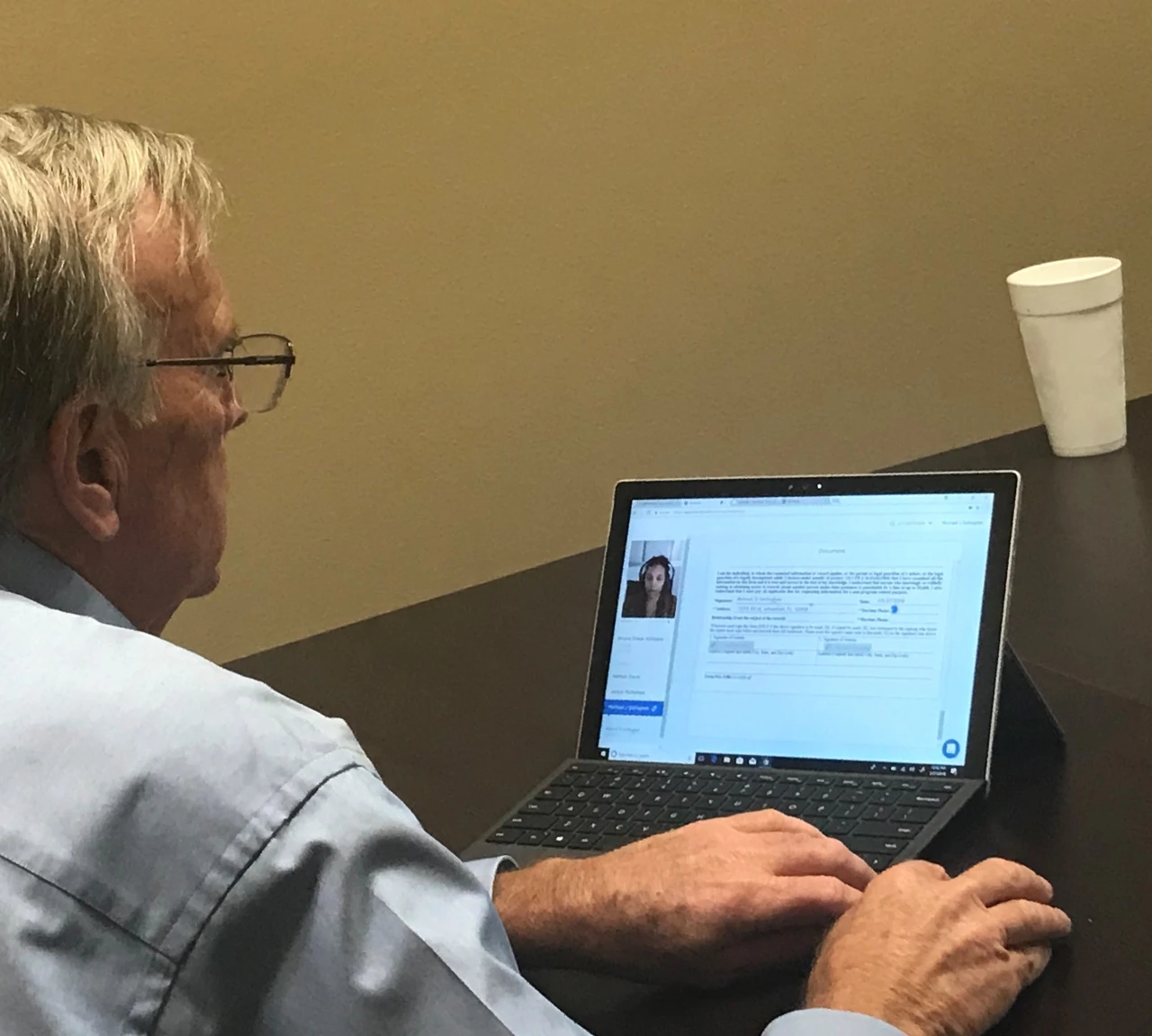

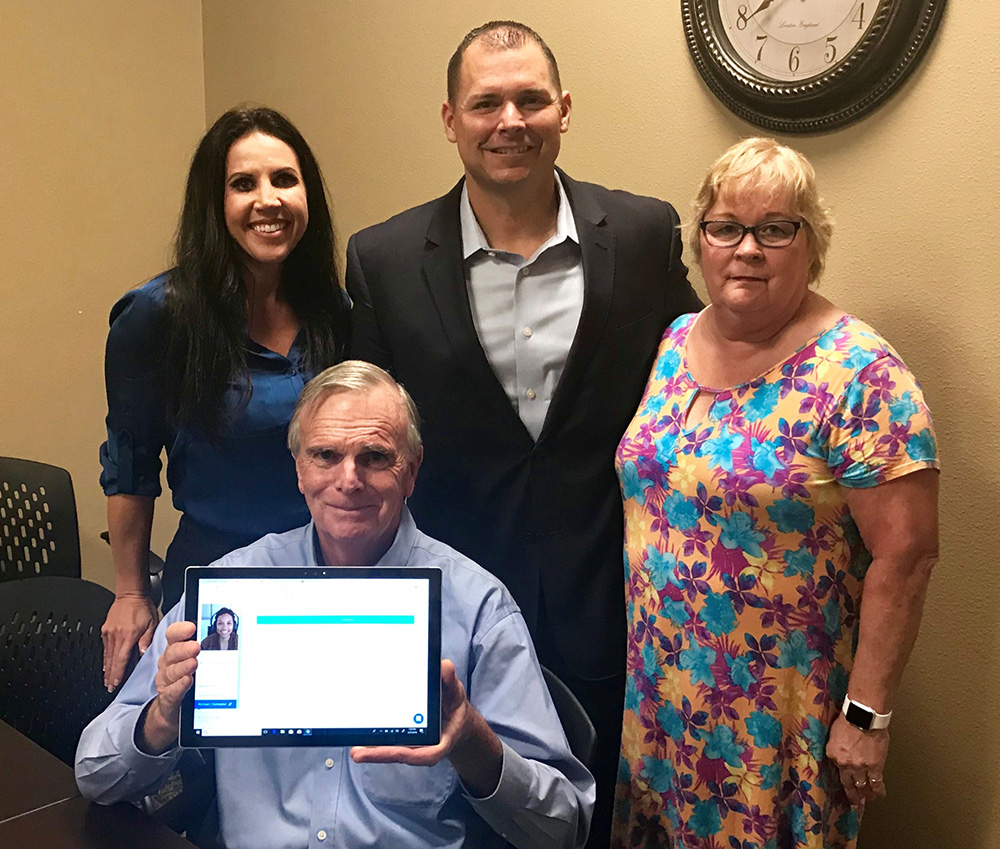

Hillsborough Title, a proud member of Florida Agency Network, suggested to one of its borrowers, Mr. Gallagher, to close his refinance transaction digitally. During the closing, Mr. Gallagher exclaimed that his digital experience was “very efficient” and “superb.” That was the goal; It’s about providing convenience and ease of use to consumers. “Our borrower was thrilled at the efficiency throughout the entire process. This transaction was a keybreakthrough in providing our clients the option of a fully digital remote closing at the time and location of their choosing,” said Aaron.

As the Chief Operating Officer of Florida Agency Network, Mike LaRosa said, “We were fortunate to have all of the necessary parties willing and able to take this historic step for the Florida title insurance industry. The Notarize platform made the idea of a RON closing experience a legitimate possibility, and the forward thinking of Westcor made it a reality. Finally, combining the right real estate, lending, and title partners allowed for a cooperative experience for Mr. Gallagher, our mutual end-consumer. We were obviously thrilled to be a part of history, and also to be able to offer Mr. Gallagher, and our future clients, this unique experience.”

Everyone working on the transaction couldn’t help but celebrate how convenient it was to close, and how they had just witnessed the future of settlement. Jackie McNamee, the closing agent for Hillsborough Title said, “I am so excited and proud to have been a part of this first fully-digital loan closing experience.” While Nate Davis, Owner of Florida Mortgage Firm said, “The days of long drives to title offices, scheduling time off work for the sole purpose of signing docs, and overseas clients searching for U.S. notaries will soon be a distant memory with this platform.”

There will always be a time and place for physical closings, the coming together of buyers, sellers, real estate agents, and lenders to meet and sign at closing. This gives a great alternative should a party not physically be able to attend.

But won’t it be great to do it all digitally. All on a tablet.

Bon Voyage HUD-1!!!

Come get social with us at booth 625 as we bid the HUD-1 farewell and cruise to the new disclosures.

https://www.youtube.com/watch?v=upg0H35VjSk#action=share

When it comes to the upcoming CFPB changes, Aaron M. Davis, Florida Agency Network's founder and CEO, is the man to speak with. Davis gave Jeremy Yohe, of American Land Title Association, his insight into the upcoming market changes in ALTA's January edition of TitleNews. In the cover story, Davis goes into detail on the new RESPA-TILA disclosures and how to excel in these changing times.

To read the full cover story, click here.

Tampa, Fla.-based Florida Agency Network introduced Mike LaRosa as its new chief operating officer.

“There have certainly been some milestones in our company and network that have been game changing,” said Aaron Davis, chief executive officer of the Florida Agency Network and its multiple brands, which include Hillsborough Title, Trident Title, Paramount Title, Tampa Bay Title, Cornerstone Title, HomePlus Title, Uptown Title, Bella Title, Performance Title & Escrow and Progressive Title Solutions. “Having the caliber of person and operator like Mike LaRosa join us was never something we could have imagined years ago. Mike brings 16 years of industry experience and the operational expertise of running one of the largest title insurance underwriters to the Florida Agency Network,”

In 1999, LaRosa began his title insurance career as associate counsel at First American Title’s divisional headquarters in Tallahassee. By 2000, he moved to Tampa to work with the partnership division, where he was promoted to vice president and counsel. He spent six years in the that role establishing affiliated business arrangement title agencies with mortgage, builder/developer and real estate professionals throughout the Southeast.

LaRosa was named Tampa Bay agency manager in 2007. His territory eventually expanded to include the southwest region of Florida. Ultimately, he was promoted to Florida state agency manager where he has spent the past three and a half years.

For the original feature, click here.

TAMPA, FLA. – April 6, 2015 – Florida Agency Network, Florida’s largest network of independent title agencies, is proud to introduce Mike LaRosa, Esq., as the new Chief Operating Officer for the company.

“There have certainly been some milestones in our company and network that have been game changing. Having the caliber of person and operator like Mike LaRosa join us was never something we could have imagined years ago. Mike brings 16 years of industry experience and the operational expertise of running one of the largest title insurance underwriters to the Florida Agency Network. We are thrilled to have Mike join our growing family,” says Aaron M. Davis, CEO of the Florida Agency Network and its multiple brands, which include Hillsborough Title, Trident Title, Paramount Title, Tampa Bay Title, Cornerstone Title, HomePlus Title, Uptown Title, Bella Title, Performance Title & Escrow, and Progressive Title Solutions.

LaRosa graduated from the University of Florida with both his Bachelor’s degree and Juris Doctor degree in 1998. In 1999, LaRosa began his title insurance career with First American Title as Associate Counsel at the company’s divisional headquarters in Tallahassee. By 2000 he moved to Tampa to work with the Partnership Division, where he was promoted to Vice President and Counsel. He spent six years in the Partnership Division establishing affiliated business arrangement title agencies with mortgage, builder/developer, and real estate professionals throughout the Southeast.

In 2007 LaRosa was named Tampa Bay Agency Manager, and his territory was eventually expanded to include the entire southwest region of Florida. Ultimately he was promoted to Florida State Agency Manager where he has spent the past three and a half years. Throughout his career within First American he had the opportunity to speak at various industry functions, and he enjoyed the privilege of being selected to participate in the company’s specialized leadership training program geared at developing its internal leaders.

The Florida Agency Network is excited to have LaRosa onboard to help grow its statewide footprint while maintaining a strong, customer-service brand commitment to the community.

To read the full feature, click here.

It's not easy to secure certification in all seven pillars of ALTA's Best Practices. However, after a long process FAN's Tampa Bay Division was able to pull it off.

Read more by clicking HERE.

Wednesday, January 7, 2015, 2:13pm EST

Margie Manning | Tampa Bay Business Journal

Florida Agency Network has acquired Bella Title, a Land O' Lakes-based real estate title company.

Financial terms were not disclosed. Mica Butterwood, owner and operator of Bella Title, will serve as Florida Agency Network's relationship manager for northern Hillsborough County, a statement said.

Florida Agency Network is an umbrella organization of title companies that have been consolidated amid industry changes. Launched by Aaron Davis, president and CEO, and with its roots in Hillsborough Title in Plant City, Florida Agency Network has grown to be the largest title organization in Florida, Davis said.

"Just five years ago, we had one office and five employees," Davis said. "Today we have 27 offices and more than 200 staffers."

The Dodd-Frank financial reform measure is driving consolidation, Davis said. Title companies are now considered part of the financial services sector, and face increasing costs of regulatory compliance, including higher E&O [errors and omissions] insurance, banking-type audits and cybersecurity mandates.

"A lot of agencies are going out of business, selling or being rolled into a larger agency like mine," Davis said.

In addition to Hillsborough Title and Bella Title, other agencies in the network are: Tampa Bay Title, Paramount Title, Homeplus Title, Cornerstone Title, Uptown Title, Trident Title, Progressive Title Solutions, Performance Title & Escrow and CU Title.

Your email is your business’s lifeblood these days. Most clients like the convenience of reading their updates on their home, on their title commitment, and everything else through the convenience of email. And, while they may or may not be following safe procedures, it should be one of your primary concerns.

After all, your clients private information is in those emails. Financial records, account numbers, names, and other forms of sensitive data that shouldn’t be released to the public. What if someone guesses your password or otherwise gets access?

There are some very good tips you can follow to keep your email safe. Most of these solutions are simpler than some recipes you’ve been dying to try or some driving maneuvers you perform daily. If you add these layers of security, you can be confident in your email’s safety.

The first line of defense against people who’d like your information is to create strong, unique, and unguessable passwords to your accounts. Many people tend to use passwords like “pa$$word1! “ when that’s one of the most easily guessed passwords. Below is a list pulled from CBS News of the 10 most common passwords last year:

If you see any of your passwords on here, you should be changing them right now. Those are the most common and they are also the most easily guessed.

Best practice for passwords is to use a random string of letters (upper and lower case), numbers, and symbols of significant length (8 or more characters). It should look more like “1dfGHt#2” than “password.”

If you’re worried about remembering passwords, use a password manager app or sync tool like iCloud Keychain or 1Password. That way, you can generate extremely secure passwords that your phone and/or computer will put in automatically for you while still maintaining the security that you need.

But, a good password isn’t worth anything if you give it away willingly. We’ve all been warned about phishing and spam, and never to click links in emails where you (a) weren’t expecting an email or (b) don’t know the sender. Those maxims are still true but there’s even more to be worried about now.

Phishing is, specifically, the act of imitating a legitimate company’s login screen to get your password. They’re getting good at replicating the official website, too. Here are some common traits of phishing emails, pulled from Microsoft:

Follow this rule of thumb if you don’t want to get caught by a phishing scam: if you receive an email from anyone asking you to login, give them your password, or otherwise give up information, do not use their links or give them that information. Instead, if you’re concerned, go to the website they’re claiming to be from yourself by hand-typing the URL into your browser. That way, you can be sure you’re at the right place.

A problem that faces real estate and title professionals in particular are schemes to get you to transfer funds to a dummy account. The emails in question will look almost exactly like real requests for transfers and if you’re not careful, you might end up sending large amounts of money to fake accounts. When in doubt, verify the transaction request with the sender if you know them, or take steps to find out if they’re legit. Use the tips above to recognize and avoid emails intended to steal passwords or cash and delete the offending messages as soon as you can.

Recovery options are also difficult because if you’re vigilant about setting a good password and avoiding/ignoring phishing but make your security questions easy to answer or easily researched, you’ve done a lot of hard work for nothing. When you set up your security questions, make sure they’re:

If you’ve ever revealed your security question’s answer anywhere, ever, don’t use it. Instead, if you’re given the option, make up your own question about something you don’t tell others, or use the question that you’ve never told anyone. Be aware, too, that some image memes that are commonly shared on Facebook are looking for information commonly found in these questions. If you know you use certain details for these questions, don’t publish them on any social media network or tell anyone you don’t trust.

Some websites (like Google, Facebook, and Twitter) have introduced what’s known as 2-factor authentication. It may sound complex but it’s actually rather simple: they require any password input to have another, smaller password generated by another device. The services I mentioned earlier all use apps on iPhones/Androids to generate the code. If you activate this system, you’ll be asked for a code each time you log in that only you, on your device, can make. That way, even if someone else has your password, the only way anyone’s getting in is if they have your code generator—and they’d need to steal your phone for that.

The only way that you’re going to lose your data and your email account if you use these tips would be to hand it to them directly. Staying safe has never been easier thanks to the basic tools that we’ve been given from the email providers themselves and the basic tips to maintaining a safe, secure email system earlier in the email: make a good password, give it to no one, don’t log in through links but rather through the sites themselves, and just practice good email management, and you’ll be fine!

Follow these basic tips to stay safe through your email:

Please fill out form below