You're doing it. You're buying a house! Since the process can be overwhelming and confusing, we've simplified it in the best way possible. What better way to explain each step than to use GIFs from one of our favorite TV shows, The Office?

Congrats on finding "The One!" At this point, your real estate agent has drafted your official contract, and the title insurance agency is starting the closing process. You're on your way to owning a new home!

Think of your earnest money deposit, or EMD, as a "good faith" deposit. It shows the listing agent and seller how serious you are about the home and getting the transaction closed. The dollar amount of your EMD is stated in your contract when it's signed. Be sure to discuss what you're comfortable putting upfront with your real estate agent. Depending on how much you agree on, it can seem like an expensive upfront cost. Your real estate agent is an expert and can advise you on the amount of money they think you should send. Take comfort in knowing the EMD will be held in your escrow account and used towards closing costs or the down payment.

Your title insurance agent will order a title search to ensure the title to your property is clear of any liens, back taxes, or other claims. To get a thorough search completed, ask your agent to request the title insurance company conduct a municipal lien search, permit search, and code enforcement search. With Florida Agency Network's offices, we offer this to each buyer via the buyer's agent.

Shortly after your offer is accepted and sent in, your agent will discuss scheduling a home inspection. You'll need to complete the home inspection quickly. Doing so will allow as much additional time possible for any follow-up inspection.

You're one step closer to closing on your home! The title commitment tells a buyer they're able to obtain a title insurance policy with that agent. The commitment contains the terms, conditions, and exclusions that will be in the owner's title insurance policy.

The home appraisal should come back at or above the contract price. The appraisal protects a buyer from paying more than the home is worth. If your home appraisal is lower than the purchase price, don't worry! Discuss your options with your real estate agent.

You'll begin to see the light at the end of the tunnel once you and your agent receive the clear to close. "Clear to Close" means the underwriter has signed-off on all documents and issued final approval on your closing.

Once your closing date is scheduled, don't forget to double-check for the required documents, identification, and time deadlines. The last thing you want is to forget to bring an item or sign an eDoc and have to reschedule your closing.

The final walkthrough is your opportunity to do one last visual inspection to make sure everything is in order. At this point, your closing starts moving much faster, and the finish line is right ahead!

We hope you're ready to sign, sign, and sign some more! While it may be exhausting and overwhelming, don't be afraid to pause and ask questions. At the closing table, your title closer and real estate agent are available to answer any questions you may have. Don't forget, this is your moment, and you can go as quickly or slowly as you prefer. You're allowed to get ice cream afterward, too!

You may or may not receive the keys to your new home at the closing table. In order to get those, the funds have to be wired to the seller. However, once they are received and confirmed, you have a new home!

You're officially the owner of a new home, and we think that is Perfectenschlag!

Every real estate agent understands that buying a home is overwhelming for many clients. There's a mountain of paperwork to sign and different fees associated with the closing process. All of these things can confuse even an experienced buyer.

Title insurance, or an owner's title policy, is often misunderstood by home buyers at closing. Buyers, especially first-time home buyers, look to real estate professionals as experts in the industry. It's important to be the advisor to your clients and help them understand the value of an owner's title policy and the risks that can arise without it.

Title insurance, or an owner's title policy, is a policy that protects the home buyers’ property rights. For the same reasons that the bank requires a lender’s insurance policy, a home buyer obtains an owner’s title policy to protect their legal rights to the property.

Here's an example: Your client purchased a new home from a builder, but the builder failed to pay the roofing company. That roofing company wants to get paid, so it files a lien against the property. Without an owner’s title policy, your client is responsible for paying that debt. This is just one example of how an owner’s title policy protects a home buyer from a variety of significant risks, such as unknown heirs, illegal deeds, forged documents, and much more. With an owner’s title policy, a buyer's property rights are protected while they own the property.

The good news is that an owner’s title policy financially protects home buyers for as long as they own the home. For Florida buyers, the price of an owner's title policy depends on the sales price of the home. Florida's promulgated rate is $5.75 per thousand, up to $100,000, and $5.00 per thousand thereafter, up to $1 million.

The party that pays for the owner’s title insurance policy varies from state to state. In Florida, the seller typically picks and pays for the owner's title policy. However, that can change depending on which county/area the property is located.

Fees can add up during the closing process, but this one-time fee gives home buyers peace of mind. After all, the home may be new to your buyer, but every property has a history.

Each state regulates its title insurance costs, and the Consumer Financial Protection Bureau (CFPB) regulates closing and settlement services to protect consumers from unfair practices. Established in 2011, the CFPB educates consumers about making smart financial decisions and holds companies accountable for any abusive or discriminatory procedures.

Title insurance can be confusing and seem like "just another expense" during the closing process. But, what's the price of your buyer's peace of mind? As a real estate professional, educating yourself and your clients on title insurance, the protections it provides, and the risks of going without it is vital.

Congrats on your new home! Now, it’s time to get prepared for your move. While there are many details to prep leading up to the big day, we’ve compiled an essential list of moving tips and things to remember based on our experiences

Take it from people who have moved numerous times and hire good movers! If it fits into your budget, we highly recommend hiring a moving company. A professional moving company knows the best way to transport your items as well as how to pack up large items to protect them during the move. However, if a moving company isn’t in your budget, recruit some awesome friends to help.

With both options, make sure to communicate clearly and often about your moving plans. This will make it less stressful for everyone. Also, it doesn’t hurt to help those who are helping you. Everyone loves pizza, right?!

This is pretty straightforward. You don’t want to get into your new home and not have any power. Make sure to call the utility companies in advance to schedule every necessity to be turned on before you arrive.

Packing can be daunting and overwhelming, but if you start as soon as you know you are moving, you can chip away at your moving tasks day by day. We’ve even created a checklist to help! We break it down by time intervals to your move date, with tips for 60-, 30-, 15- and 3-days out from your move date. Download our checklist now!

While you’re at the packing stage, we recommend decluttering. This is your opportunity to get rid of things you no longer need or use. You can give those items to friends or donate to people in need. Bonus? You’ve got less items to pack. It’s a win – win!

Unless you plan on unpacking everything the same day you move, we highly recommend creating a survival kit (or bag). Moving day is exhausting, and the last thing you want to do is search through your boxes to have your essentials handy.

Instead, you can pack an overnight bag like you would if you were traveling. Also, if you want to include some food items and entertainment, you can make sure those are all in one box. What are the things you need to survive in your new home for the next 48-72 hours (or however long you plan on taking to unpack)? Those items are what you need in your survival bag.

Safety comes first all the time. Even if your home is a new build, you should change the locks. You don’t know who or how many people have had access to the keys you were given.

It’s very GREEN and budget friendly to use what you already have as packing materials. You can wrap fragile items in sheets or use them to fill empty space in boxes. Plus, once you’re unpacked, you’ll have less trash to throw away. Just be sure to pack your daily, must-have linens in your survival kit before using them as packing supplies.

And, while we’re utilizing items we already have, how about using your luggage and other similar items as packing receptacles? You’re already taking it with you. This is your time to work smarter, not harder.

Your movers can’t read your mind and don’t have x-ray vision. Labeling each box, either with color codes or text, can help your movers know where to put your items. This is where communication comes in handy, as well. If yellow notates kitchen items, and your movers know you need all kitchen items in, you guessed it, your kitchen, they’ll know to grab all those boxes and put them together.

While your upcoming move might be overwhelming, these 7 tips will help you prepare for the big day! If you need a more in-depth checklist and guide for your move, download our moving guide today. It’s filled with checklists and tips for your moving day.

As with most things in life, everything starts with a vision.

“In the world of real estate settlement services, it’s a vision to buy, refinance, and sell a house on a tablet device. No pens. No paper. No rubber-stamped notary seal. No 100’s of pieces of paper to be purchased, printed, signed, shipped and scanned. Oh, and shredded, who can forget shredding? Don’t get me started,” says Aaron M. Davis, CEO of Florida Agency Network (FAN).

For the world of real estate closings, the vision has been for years to transform an industry’s archaic processes through innovation and new technology. Aaron has made FAN’s purpose to innovate and blaze the path for homeownership to become more seamless, paperless, and less cumbersome for the consumer. His passion for revolutionizing the title insurance industry started decades ago, sitting in his mother’s title agency in Plant City, Florida.

“I remember the days of hand balancing HUD statements. Policies in triplicate form. Our first fax machine, our first desktop computers, Novell servers, dial-up modems, and paper. Lots and lots of paper. 200 pieces of paper per file, 30 files per storage box, and lugging boxes of files in and out of storage.”

Settlement has come light years from those days, however one piece has been missing. Remote Online Notarization, or RON for short. The ability to interface remotely via safe, online portal, digitally signing documents, and affixation of the electronic notary seal, all on a tablet device.

Pat Kinsel started Notarize because he had one too many bad notary experiences. In his case, the last straw was a notary agent who forgot to sign his document just before he went on vacation. He didn’t learn of the error until he was gone. Pat knew “there has to be a better way!”

Developing that better way required a sharp focus on innovating both in the areas of technology and public policy. In researching the process, Pat discovered the Commonwealth of Virginia had passed a law in 2011 to become the first state to allow remote electronic notarization, and all 50 states must recognize Virginia’s ability to transact business in this new way. Building upon these policies, and with cooperation from the Commonwealth of Virginia, Pat and his team have spent the past years developing an amazing product to fundamentally transform the notary process for consumers, businesses, and agents. Technology and policy have converged, and Notarize is bringing notary into the 21st Century.

When Aaron met the team at Notarize in mid-2017 and demoed their product, he knew he had just witnessed the missing piece to the puzzle, and the future of real estate settlement: Paperless, convenient, efficient, and best of all, secure.

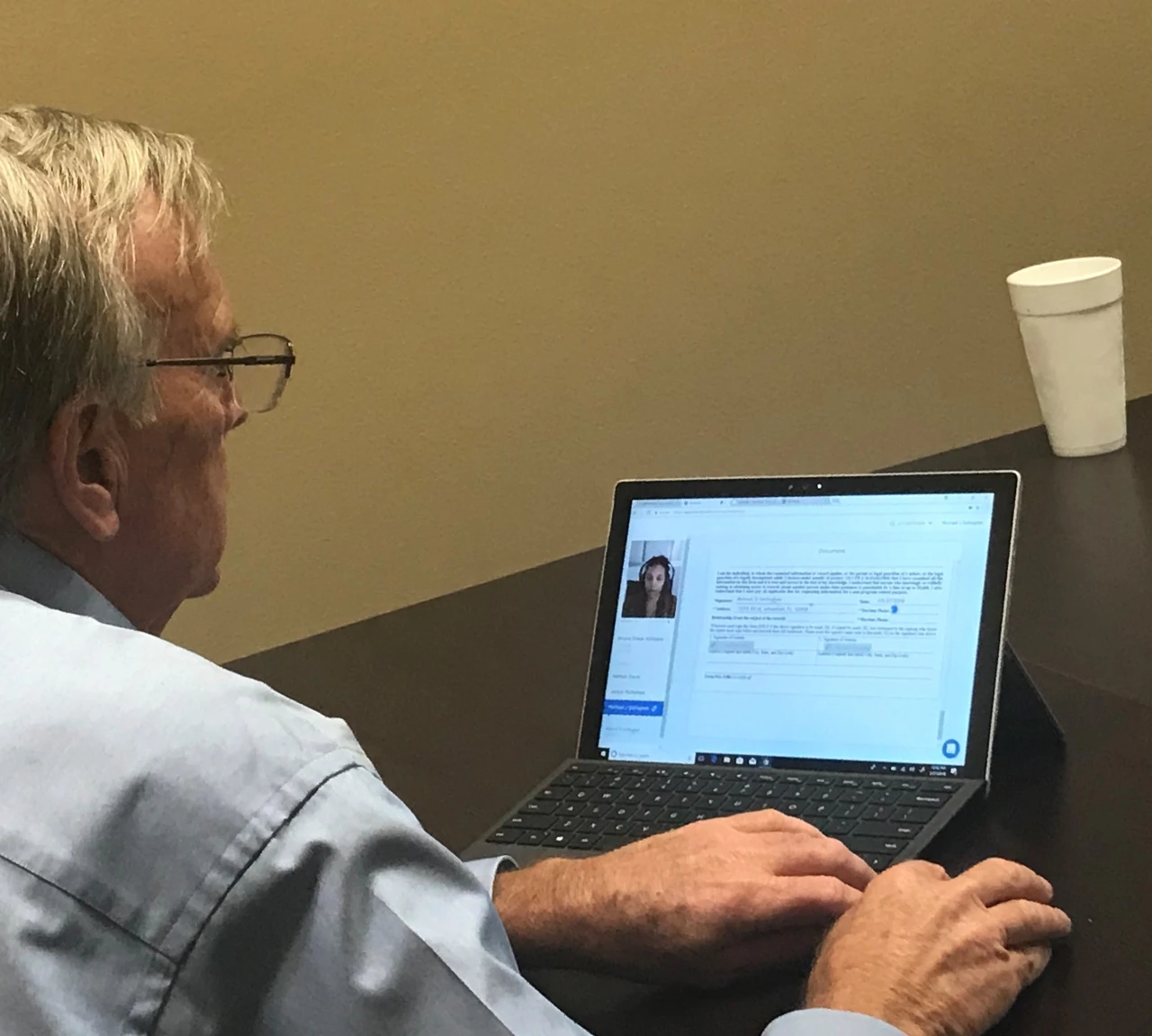

Fast forward to today, thanks to a partnership and friendship with Pat Kinsel and Adam Pase of Notarize, FAN could collaborate with a company whose vision and innovative pursuit in the online closing space is revolutionizing the real estate closing process. One final element in the equation came down to the backing from Westcor Land Title Insurance. With Westcor’s support and Notarize’s technology, FAN conducted its first fully-digital, 100% paperless, remote online notarization closing in March 2018.

The vision didn’t stop there. “After completing our first fully-digital purchase transaction using an online notary earlier, we knew the next step would be utilizing the technology for a refinance transaction,” said Aaron.

Hillsborough Title, a proud member of Florida Agency Network, suggested to one of its borrowers, Mr. Gallagher, to close his refinance transaction digitally. During the closing, Mr. Gallagher exclaimed that his digital experience was “very efficient” and “superb.” That was the goal; It’s about providing convenience and ease of use to consumers. “Our borrower was thrilled at the efficiency throughout the entire process. This transaction was a keybreakthrough in providing our clients the option of a fully digital remote closing at the time and location of their choosing,” said Aaron.

As the Chief Operating Officer of Florida Agency Network, Mike LaRosa said, “We were fortunate to have all of the necessary parties willing and able to take this historic step for the Florida title insurance industry. The Notarize platform made the idea of a RON closing experience a legitimate possibility, and the forward thinking of Westcor made it a reality. Finally, combining the right real estate, lending, and title partners allowed for a cooperative experience for Mr. Gallagher, our mutual end-consumer. We were obviously thrilled to be a part of history, and also to be able to offer Mr. Gallagher, and our future clients, this unique experience.”

Everyone working on the transaction couldn’t help but celebrate how convenient it was to close, and how they had just witnessed the future of settlement. Jackie McNamee, the closing agent for Hillsborough Title said, “I am so excited and proud to have been a part of this first fully-digital loan closing experience.” While Nate Davis, Owner of Florida Mortgage Firm said, “The days of long drives to title offices, scheduling time off work for the sole purpose of signing docs, and overseas clients searching for U.S. notaries will soon be a distant memory with this platform.”

There will always be a time and place for physical closings, the coming together of buyers, sellers, real estate agents, and lenders to meet and sign at closing. This gives a great alternative should a party not physically be able to attend.

But won’t it be great to do it all digitally. All on a tablet.

As you’ll see in this video, many of your questions should focus on potential problems and maintenance issues.

Does anything need to be replaced? What things require ongoing maintenance like paint, roof, heating and AC, appliances and carpet?

Also ask about the house and neighborhood focusing on quality of life issues. Be sure the seller's or real estate agent's answers are clear and complete.

Like the video says, ask questions until you understand all of the information they've given.

Making a list of questions ahead of time will help you organize your thoughts and arrange all of the information you receive. The HUD Home Scorecard can help you develop your question list and keep a record for each potential home.

Like the video says, the two don't really compare at all.

The one advantage of renting is being generally free of most maintenance responsibilities. But by renting, you lose the chance to build equity take advantage of tax benefits and protect yourself against rent increases.Also, you may be at the mercy of the landlord for housing.

Owning a home has many benefits. When you make a mortgage payment, you are building equity increasing YOUR net worth.

Owning a home also qualifies you for tax breaks that assist you in dealing with your new financial responsibilities like insurance, real estate taxes, and upkeep which can be substantial. But given the freedom, stability, and security of owning your own home they are worth it.

Like the video shows, your home should fit the way you live, with spaces and features that appeal to the whole family.

Before you begin looking at homes make a list of your priorities - things like location and size.

Establish a set of minimum requirements and a 'wish list." Minimum requirements are things that a house must have for you to consider it while a "wish list" covers things that you'd like to have but that aren't essential.

Please fill out form below