Every real estate agent understands that buying a home is overwhelming for many clients. There's a mountain of paperwork to sign and different fees associated with the closing process. All of these things can confuse even an experienced buyer.

Title insurance, or an owner's title policy, is often misunderstood by home buyers at closing. Buyers, especially first-time home buyers, look to real estate professionals as experts in the industry. It's important to be the advisor to your clients and help them understand the value of an owner's title policy and the risks that can arise without it.

Title insurance, or an owner's title policy, is a policy that protects the home buyers’ property rights. For the same reasons that the bank requires a lender’s insurance policy, a home buyer obtains an owner’s title policy to protect their legal rights to the property.

Here's an example: Your client purchased a new home from a builder, but the builder failed to pay the roofing company. That roofing company wants to get paid, so it files a lien against the property. Without an owner’s title policy, your client is responsible for paying that debt. This is just one example of how an owner’s title policy protects a home buyer from a variety of significant risks, such as unknown heirs, illegal deeds, forged documents, and much more. With an owner’s title policy, a buyer's property rights are protected while they own the property.

The good news is that an owner’s title policy financially protects home buyers for as long as they own the home. For Florida buyers, the price of an owner's title policy depends on the sales price of the home. Florida's promulgated rate is $5.75 per thousand, up to $100,000, and $5.00 per thousand thereafter, up to $1 million.

The party that pays for the owner’s title insurance policy varies from state to state. In Florida, the seller typically picks and pays for the owner's title policy. However, that can change depending on which county/area the property is located.

Fees can add up during the closing process, but this one-time fee gives home buyers peace of mind. After all, the home may be new to your buyer, but every property has a history.

Each state regulates its title insurance costs, and the Consumer Financial Protection Bureau (CFPB) regulates closing and settlement services to protect consumers from unfair practices. Established in 2011, the CFPB educates consumers about making smart financial decisions and holds companies accountable for any abusive or discriminatory procedures.

Title insurance can be confusing and seem like "just another expense" during the closing process. But, what's the price of your buyer's peace of mind? As a real estate professional, educating yourself and your clients on title insurance, the protections it provides, and the risks of going without it is vital.

Closing on your new home can be both exciting and confusing. There are many factors to consider throughout the process. One item to consider is how you’ll hold the title of your new Florida home. Buyers can easily overlook this detail during the closing process, which can be detrimental if you decide to sell your home.

Your title agent can answer general questions or direct you to their real estate attorney to provide more information and answer questions. Here are the ways for you to hold title to real estate in Florida:

For a single, unmarried home buyer, this option is the most popular way to hold the title to their home. It’s simple and straight forward. It just means the title will be held solely under their name. Married individuals can hold title as sole ownership as well. For example, with an investment property, one individual may not want any ownership in the property. In this case, that spouse will have the Deed drafted for the property showing only one person holding the title. With this option, you may not receive any special tax breaks or other advantages of holding title in sole ownership. If the sole owner dies, any property held this way may be subject to probate court proceedings, which cost money and takes time.

With this option, each spouse owns an equal portion of the property for as long as they are both alive and legally married. Each spouse’s interest passes to the other upon death. This option also has some level of protection, in that a judgement against one spouse may not attach to the property.

Each tenant owns an undivided pro rata share of the property and must take ownership at the same time. Also, each tenant will have a right of survivorship, so if one of them passes away, their share will transfer to the surviving tenant (or tenants). The will of the tenant who passed away has no impact on the joint tenancy property. Joint tenancy also allows the surviving tenants to avoid probate expenses and delays when one of the tenants dies. The surviving tenants need to record an affidavit and provide a death certificate to clear the title

If there are two or more buyers, the individuals can opt to hold title as tenants in common. Tenancy in common is a popular option for individuals who aren’t married or are investors, friends, or family. As tenants in common, each tenant (individual) owns a certain percentage of the property, typically equal shares among the owners. In the event any owner should pass, their interest will vest in their estate or heirs at law. Their interest will not pass to survivors. The property will be subject to probate court expenses and delays.

Choosing the most beneficial way to take title is often overlooked by buyers. However, this step is critical to your closing transaction and situations later down the road.

It’s crucial to speak with a real estate attorney when deciding how to hold title on your Florida real estate property. We have in-house attorneys with years of experience in Florida real estate. By choosing to close with any of Florida Agency Network’s title agencies, you and your agent have access to those attorneys, and many more resources throughout your closing transaction.

As a new homeowner, protecting your investment is at the top of the “to-do” list. From buying security systems to obtaining homeowners insurance, there are countless ways to protect your investment. Obtaining title insurance through an Owner’s Title Insurance Policy, insures your homeownership rights aren’t affected after you’ve purchased your home.

Here is a list of a few examples that can come up after your home purchase.

For buyers, one of the most important ways to protect your property rights is getting an owner’s title insurance policy, or title insurance. Agencies within The Florida Agency Network provide homeowners with the peace of mind and the smooth closing they deserve.

Contact any of our offices for more information on our closing services and how we can help you during the closing process.

Here's a little disclaimer Aaron M. Davis, CEO of Florida Agency Network, likes to give when speaking on title insurance in Florida.

"Florida, where a judgment can attach to a piece of property simply by filing a document with the clerk, and the name doesn’t even have to be spelled correctly.

Florida, where the county may or may not have to actually FILE an enforcement action on a property for it to attach, as long as they were thinking about doing it at some time.

Florida, where an unlicensed contractor can pull a permit on a house to put on a new roof, not close a permit, and 10 years later you have to hire a licensed contractor to go back, fix the prior’s work, and close the permit.

Florida, were the seller picks the title agent or attorney, and pays for title insurance, but only depending on the county you are in. Or, even depending on what PART of a county you're in."

Across the country, there are 37 states where the buyer picks/pays for title and 12 states where it’s customary for the seller to do so.

Where the Buyer picks in:

Then, seller picks in the majority of the other areas...

HUH???

Title scholars, settlement experts, underwriting counsel, and others who still say things like “HUD statements, policies in triplicate, dot matrix printers, and white out," have contemplated WHY this occurs in Florida.

Title scholars, settlement experts, underwriting counsel, and others who still say things like “HUD statements, policies in triplicate, dot matrix printers, and white out," have contemplated WHY this occurs in Florida.

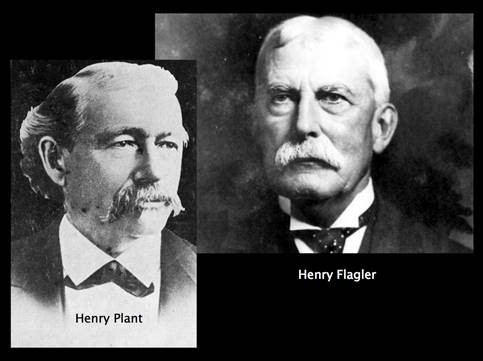

Well, Aaron has figured it out! We can blame two men named Henry. (Of course, it's a man's fault.)

These two gentlemen were railroad tycoons who ventured deep into Florida. The areas they ended up in became tourist destinations, with great beaches, water access, and lots of construction opportunities. Plant’s rail line landed in Sarasota, and Flagler’s line had a few stop down the East coast of Florida, landing in Palm Beach and Miami.

These two gentlemen were railroad tycoons who ventured deep into Florida. The areas they ended up in became tourist destinations, with great beaches, water access, and lots of construction opportunities. Plant’s rail line landed in Sarasota, and Flagler’s line had a few stop down the East coast of Florida, landing in Palm Beach and Miami.

With all those tourists and construction came the attorneys who handled those transactions, several of who previously resided in New York. And in New York, you guessed it - it’s customary for the buyer to pick and pay for title.

As for coastal areas, well, those buyers are typically wealthy, so we guess they just get stuck with the bill.

Today's Title Report update features FAN's latest announcement on the partnership with SETCO Services LLC.

"Florida Agency Network (FAN) is joining forces with SETCO Services, LLC headquartered in Destin, Fla. FAN CEO Aaron Davis told The Title Report this latest venture marks a new initiative by the title insurance agencies..."

To read the full feature, click HERE.

To read the press release, click HERE.

Florida’s premier network of independent title agencies joins forces with the largest independent agency in North Florida to bring settlement services to real estate professionals throughout the state.

Tampa, Fla. – August 12, 2016 – Florida Agency Network (FAN), Florida’s largest network of independent title insurance agencies, announces that it is joining forces with SETCO Services, LLC,

headquartered in Destin, FL. This latest venture marks a new initiative by FAN to grow the Network through the creation of strategic relationships in certain key Florida markets where FAN is currently under-represented. As opposed to other FAN locations established through organic growth or formalized partnerships, the SETCO announcement represents FAN’s first non-equity relationship where the entities will support one another and avail themselves of each other’s locations, client relationships,

marketing, and other ancillary services.

Through these new relationships the network benefits by adding additional locations to its statewide footprint, and better service for its clients through additional brick and mortar offices with local

knowledge and expertise, while the new FAN agent partners gain access to vast resources and a robust menu of products and services.

“We are incredibly excited to announce the formation of this strategic partnership with SETCO Services, LLC, which is a first of this kind for us. It represents a new approach to true partnership amongst independent agents in Florida,” says Aaron M. Davis, CEO of the Florida Agency Network. “We are able to significantly expand our territory through additional brick and mortar locations while keeping that ‘boots on the ground’ local knowledge to better serve our client base. At the same time, both of our companies share the same vision and commitment to industry compliance through the completion of our SOC 1 and SOC 2 certifications. We plan to focus our combined energies and expertise on serving a broader range of customers and delivering more efficient solutions across the state.”

SETCO Services, LLC will utilize the back-office solutions provided by FAN. Centralizing the non-core title services will allow SETCO Services, LLC to better focus on providing exceptional service for every real estate professional while maintaining top-notch security and protection of NPPI via FAN’s compliance controls.

“The relationship with Florida Agency Network will allow SETCO to offer more diverse yet streamlined services which will only further improve the customer service to our clientele,” says George T. Brannon, Jr., Chief Operating Officer of SETCO Services, LLC. “The Leadership and goals of our companies are like-minded and this opportunity will provide all organizations partnered with Florida Agency Network to grow more efficiently and effectively in the markets they choose to lead.”

FAN’s tight security controls consist of SSAE 16 SOC 1 and SOC 2, ALTA Best Practices Certification (pillars 1-7 via 3rd Party), and support through its I.T. affiliate, Premier Data Services (PDS). PDS is a Managed Service Provider that offers solutions for unmet needs within the real estate and settlement services industry.

The National Settlement Services Summit offers a destination for industry leaders to come together for "unrivaled networking and learning." This year's theme is Knowledge In Action and will offer educational breakout sessions with keynote speakers who are highly regarded within the Settlement Services Industry. One of which will be our very own Aaron M. Davis, CEO/President of Florida Agency Network.

Davis will be speaking in the Breakout Session "Business NOT As Usual" on Tuesday, June 7 from 9:40 am - 10:40 am. Davis, along side Cynthia McGovern, Founder of Orange Leaf Consulting, will discuss life in a post-TRID world and how to embrace the changes to elevate business results.

To register for NS3, visit www.tinyurl.com/NS3Registration. You can save $30 when you use the Coupon Code: SPEAKER.

Page 3 of your Closing Disclosure will compare cash requirements from your Loan Estimate to your actual final charges. If “Did this change?” is “YES” notes for changed sections should be provided.

The bottom line final “Cash to Close” is the money you will need in-hand in three business days.

If your transaction has a Seller the summary table will show a line by line comparison of Borrower to Seller transaction details.

If there is no Seller you may see a Payoffs and Payments table instead.

Review the summary tables to understand the transaction and your financial commitments at loan consummation.

Page 2 of your Closing Disclosure details specific closing costs.

Section A includes: Origination charges collected by the lender Origination fees paid to brokers, loan officers or other parties and Discount Points - prepaid interest. These figures should match your original Loan Estimate.

Section B covers services for which you could NOT shop. The total of these should be within 10% of the total from your Loan Estimate.

Section C covers services you could shop. If you chose providers from the lender’s written list, costs should be within 10% of Loan Estimate. The set of services you can shop may vary on different loans.

The Recording Fees in Section E should be within 10%; other costs in E, plus F, G and H, may vary from your Loan Estimate without tolerance limits.

This page will also break out the costs YOU will pay, before or at closing; the costs the Seller will pay, any costs paid by others and any credits from your Lender.

Please fill out form below